TrustPlus resources to support worker financial health

TrustPlus resources to support worker financial health

Personal Finance Coach Elise Nussbaum on financial mindfulness around the holidays

Do your employees have the resources they need to thrive through the holiday season, avoiding the financial stress that drags on health and productivity? Do your [...]

What your workers should know about the return of student loan payments

43.5 million federal student loan borrowers will need to make payments next month for the first time in three years. Smart employers are providing workers with information and resource [...]

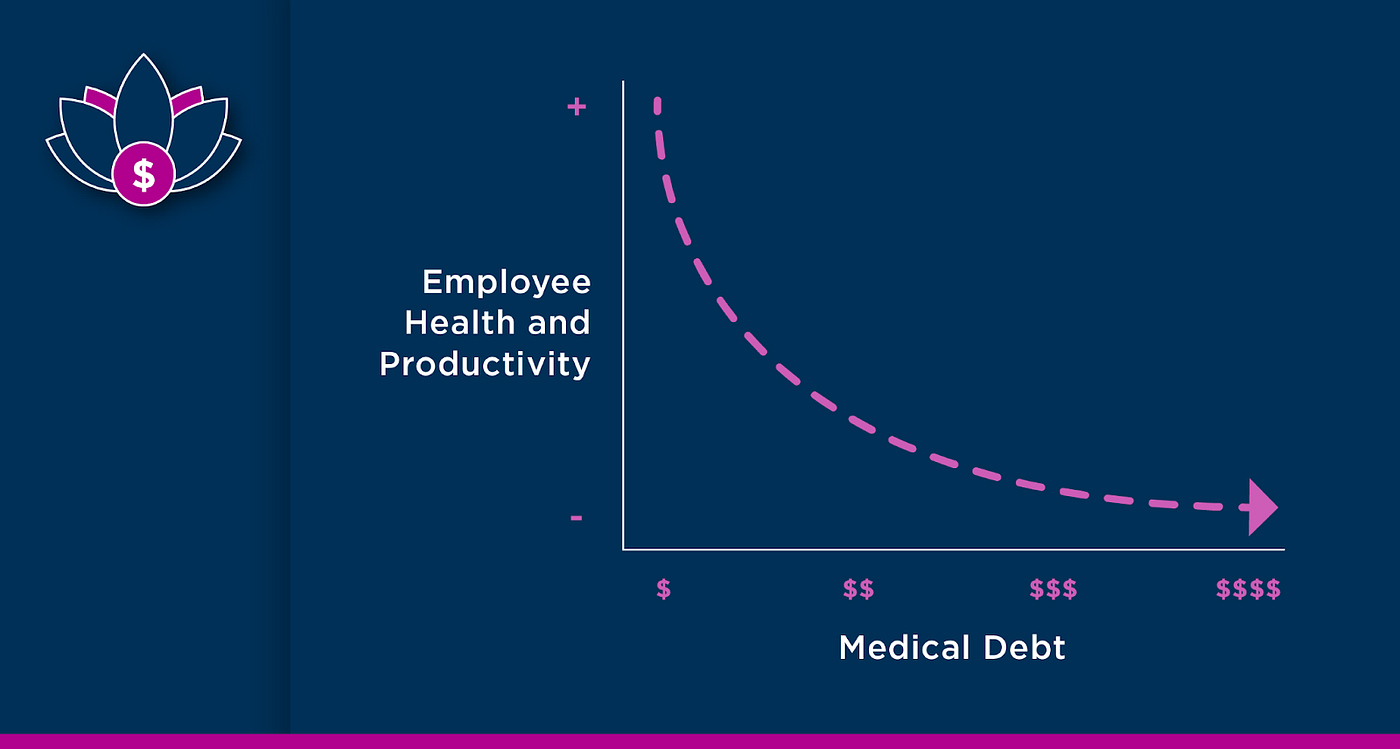

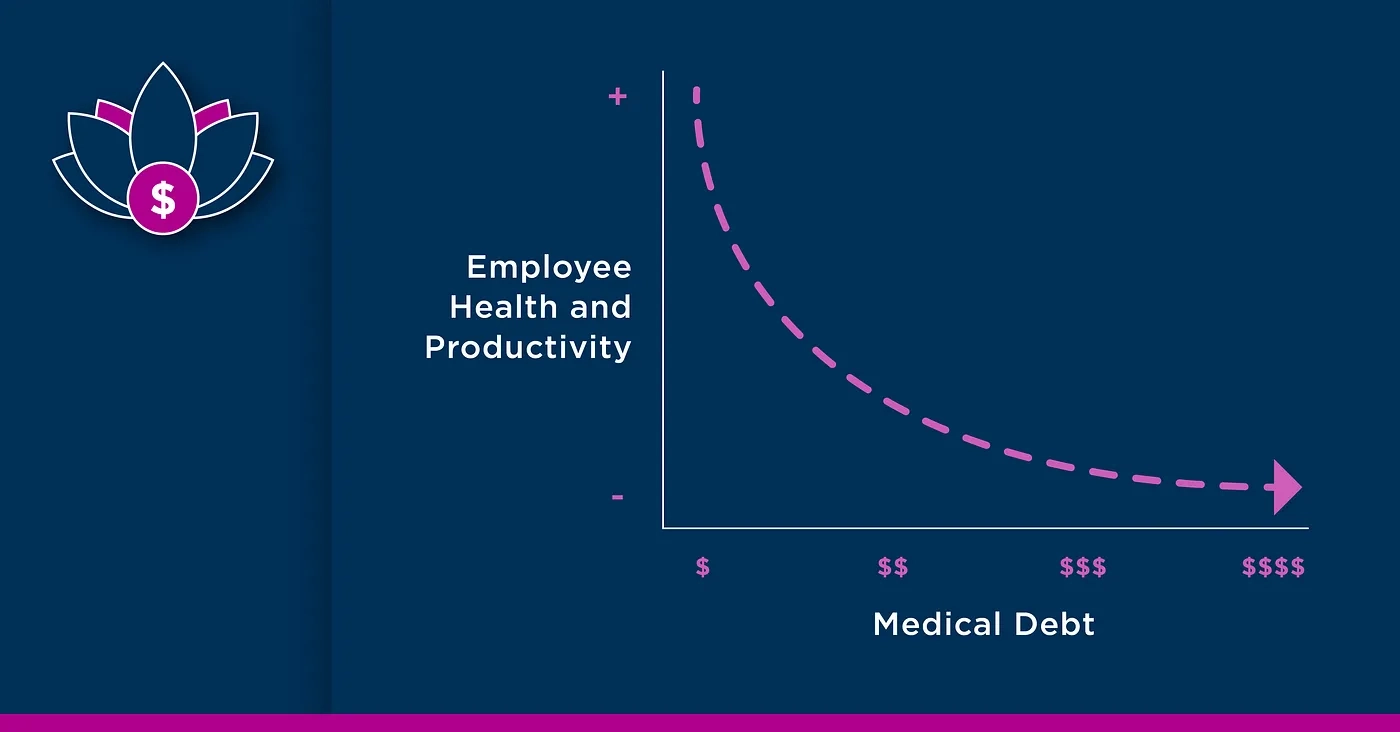

Medical debt is forcing workers to cut spending on necessities

Medical debt has negative and compounding impacts on the financial, mental and physical health of low- to moderate- income workers, finds new research from Neighborhood Trust Financial Partners and RIP [...]

Defined contribution plan sponsors with financial wellness programs “more often see their retirement plans as effective”

85% of defined contribution plan sponsors feel a strong sense of responsibility for employee financial wellness, up from 59% in 2013, finds J.P. Morgan Asset Management. [...]

A strategy for employers to boost productivity, health, and retention this back-to-school season

Back-to-school season is a stressful time financially for many of our Personal Financial Coaching clients, as it is for millions of workers across the country. Back-to-school [...]

Record credit card debt is a drain on workers, employers

Sophisticated employers are rolling out financial wellness benefits to help employees manage debt and strengthen credit, with their employees’ wellness and the bottom line in mind. [...]

Medical debt is a growing problem for workers

New research from Neighborhood Trust and RIP Medical Debt offers insights on workers’ medical debt challenges and recommendations for employers. Alarming results of new research [...]

Administration asks employers to extend enrollment periods for group health plans for workers losing Medicaid coverage

3.8 million workers who are expected to lose Medicaid coverage are eligible for health insurance through their employers: “…it is in the interest of employers to ensure that their [...]

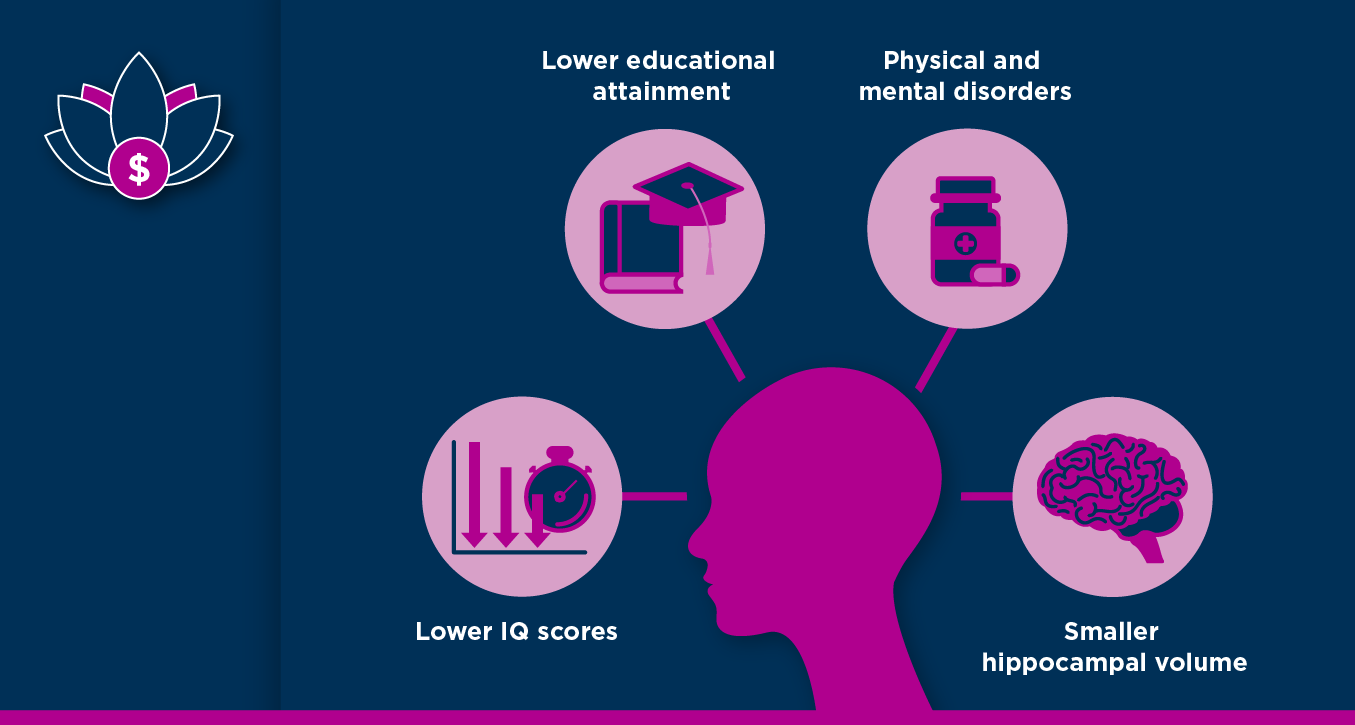

What employers should know about Secure 2.0, student loans, and retirement

The financial stress of student loan debt takes a toll on workers’ physical and mental health and productivity, and your bottom line or social impact. Secure 2.0 makes it [...]

Why employers should care about homeownership

June is National Homeownership Month. The stability, affordability, and predictability of costs that come with homeownership can make workers more productive, yet systemic racism sustains the stubborn Black-white homeownership [...]

3 steps to prepare for making federal student loan payments again

The federal student loan payment moratorium is slated to end this summer. Call your servicer now; pick the repayment strategy that works best for you; and start setting aside [...]

How to negotiate with a debt collector

Household debt recently hit a record high and roughly 64 million people have debt in collections which can hamper credit, financial, physical, and mental health for years. TrustPlus Personal [...]

Rising household debt is a growing problem for employers

To help solve it, this Mental Health Awareness Month, organizations should incorporate Personal Financial Coaching into their mental health benefits, recognizing the connections among worker financial and mental health [...]

Key levers for boosting employee financial health

Paying off student loan or credit card debt and having household income increase from less than $30,000 to $30,000+ cut the chances of becoming intermittently Financially Unhealthy by roughly [...]

Most of your employees are stressed about money

70 percent of people in the U.S. are stressed about their finances and 58 percent are living paycheck to paycheck including a majority of workers earning $100,000+. [...]

Solving for employees stressed about holiday debt

Strengthening your credit and debt benefits can help boost their health and productivity, alongside your recruiting, retention, profits, and impact. Here are four things to consider. [...]

Financial wellness benefits for employees, 2023 in review

Employees’ top financial stressor went from saving for retirement to saving for emergencies and making it to the next paycheck, amidst rising credit card, auto, medical, and student loan [...]

Help employees save for emergencies and retirement in 2024

Strengthen employee financial health with Secure 2.0 provisions to kick-in “after December 31, 2023.” A financial wellness benefits paradigm shift is underway as employers recognize employees [...]

Employers focused on employee financial stress in 2023

TrustPlus articles that generated the most engagement in 2023 offer a window into what's of most interest to employers when it comes to the latest research, news, and best practices [...]

Short-term financial concerns top of mind for employees

Secure 2.0 offers employers solutions to reduce employee financial stress. New emergency savings options and student loan repayment matches for retirement contributions kick in after December 31. [...]

Employee financial wellness hits new low

Two-thirds (67%) of employees believe the cost of living is outpacing growth in their salary or wages, per Bank of America’s annual Workplace Benefits Report; more employees prioritizing emergency savings. [...]

Financial stress distracts majority of workers on the job; nearly six in ten struggle with caregiving responsibilities

Household bills, lack of emergency savings, replace retirement savings for the first time as the top financial stressor according to the fourth annual Workplace Wellness Survey from the Employee [...]

Independent Drivers Guild invests in the financial health of its members with TrustPlus

Personal financial coaching, digital tools, and resources from TrustPlus now available to tens of thousands of New York City drivers in the nation’s largest driver-led advocacy group [...]

Boost employee financial and mental health with emergency savings benefits

Insufficient emergency savings weighs on mental health, per a recent Bankrate survey. This World Mental Health Day, we explore what you can do to ensure your employees have the support [...]

Personal Finance Coach Elise Nussbaum on financial mindfulness around the holidays

Do your employees have the resources they need to thrive through the holiday season, avoiding the financial stress that drags on health and productivity? Do your [...]

What your workers should know about the return of student loan payments

43.5 million federal student loan borrowers will need to make payments next month for the first time in three years. Smart employers are providing workers with information and resource [...]

Medical debt is forcing workers to cut spending on necessities

Medical debt has negative and compounding impacts on the financial, mental and physical health of low- to moderate- income workers, finds new research from Neighborhood Trust Financial Partners and RIP [...]