New research from Neighborhood Trust and RIP Medical Debt offers insights on workers’ medical debt challenges and recommendations for employers.

Alarming results of new research from Neighborhood Trust Financial Partners and RIP Medical Debt suggest workers with employer-provided health insurance “still reported high rates of medical debt (70%), risk of accruing future medical debt (40%), and stress due to medical debt (40%).”

“Insurance Alone is Not Enough” draws on the experiences of TrustPlus clients and RIP Medical Debt beneficiaries, adding to a growing body of research which suggests medical debt is a pervasive problem for the majority of U.S. workers.

A growing problem for U.S. workers, businesses

Per KFF and NPR, 57% of adults reported medical debt at least once in the past five years, 24% reported currently being past due, and “it’s an even greater challenge for people of color: at least half of Black (56%) and Hispanic (50%) adults said they have debt due to medical or dental bills, compared to 37% of white adults.”

Part of a multiphase effort by Neighborhood Trust and RIP Medical Debt to raise awareness of the problem and identify solutions, the new brief offers insights on workers’ medical debt challenges and recommendations for employers.

Confusing, unaffordable health insurance is a drain on physical and mental health of workers and a waste of employers’ spending on benefits

Nearly half of workers with employer-provided health insurance reported struggling to understand their coverage.

Confusion around insurance or complementary benefits equals a lower ROI on your employer healthcare benefit spending, when workers are not equipped to make use of the benefits available to them.

Meanwhile, over 60% of workers with coverage through their employer reported struggling to afford prescription medications.

Nearly 50% of respondents didn’t have enough money to contribute to an HSA or FSA, and 45% cited trouble affording their monthly insurance premium. 30% struggled to afford copays and 25% struggled to predict upcoming health-related costs.

When employees aren’t equipped to fulfill out-of-pocket requirements, they aren’t able to maximize the coverage they do have and end up with worse physical, mental, and financial health outcomes.

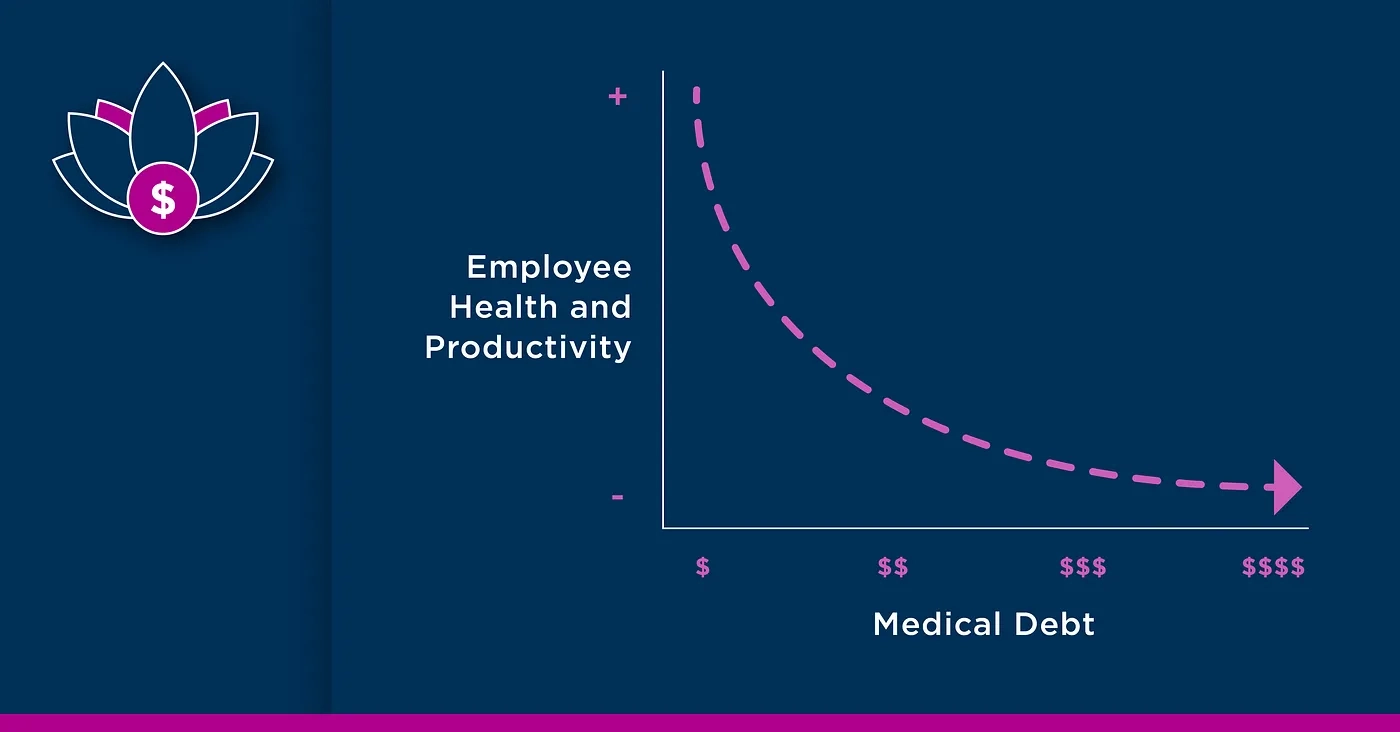

Deferred care caused by insufficient coverage and medical debt translates to worse health outcomes, which in the long run results in missing work, reduced productivity, increased healthcare costs, and job attrition.

The toll on workers’ mental health is notably worse for those with lower incomes: 45% of respondents earning under $100,000 said medical debt had a negative impact on their mental health compared to only 15% of $100,000+ earners.

The financial stress and negative health outcomes caused by confusion over coverage and unaffordable costs is bad news for mental health, productivity, and wellness, and for your bottom line.

Recommendations for employers

The brief elucidates why insurance is not enough on its own to prevent medical debt or its negative impacts on your business and workers, offering the following recommendations:

Tap workers’ insights: The authors suggest starting with a survey of your own employees or focus groups to understand to what degree they’re struggling with medical debt; ask them what would be most helpful to them.

Provide prorated employer premium subsidies based on salary to increase equitable outcomes: Offer a benchmark dollar amount for what someone with the same health background and demographics as a given employee typically spends on healthcare annually.

Provide the option to easily adjust HSA contributions per paycheck.

Create a hardship fund: They have demonstrated benefits for beneficiaries and nonbeneficiaries who feel supported knowing it’s there if they need it.

Read “Insurance Alone is Not Enough.”