How It Works

TrustPlus Coaches help with debt, credit, and savings

TrustPlus Coaches help with debt, credit, and savings

TrustPlus Personal Finance Coaches work one-on-one with your employees on an ongoing basis to optimize debt, strengthen credit, and build savings, providing on-demand expertise, resources, and tools tailored to each member of your team.

TrustPlus Personal Finance Coaches work one-on-one with your employees on an ongoing basis to optimize debt, strengthen credit, and build savings, providing on-demand expertise, resources, and tools tailored to each member of your team.

When your employees are financially secure, your business or organization thrives.

Schedule a call, or email us at [email protected] with questions today.

Schedule a call, or email us at [email protected]

with questions today.

TrustPlus for Employers

TrustPlus for Employers

Expert: We’ve honed our proprietary Personal Finance Coaching model and training over three decades, utilizing the latest research in behavioral economics and serving nearly 100,000 workers at employers of all sizes from New York to California.

Easy: We make it easy to help your employees ease the stress of the everyday money worries that hamper wellness and productivity. As long as they have a phone or internet connection, our TrustPlus Financial Coaches can help them strengthen credit, optimize debt, and build savings while maximizing the benefits you already offer.

Exceptional: Ongoing relationships with TrustPlus Personal Finance Coaches are unique among financial wellness benefits and lead to ongoing impact for employees and sustainable value for employers. We put the personal in personal finance.

Getting started is easy: Start boosting the financial health, wellness, and productivity of your workers today.

Getting started is easy: Start boosting the financial health, wellness, and productivity of your workers today.

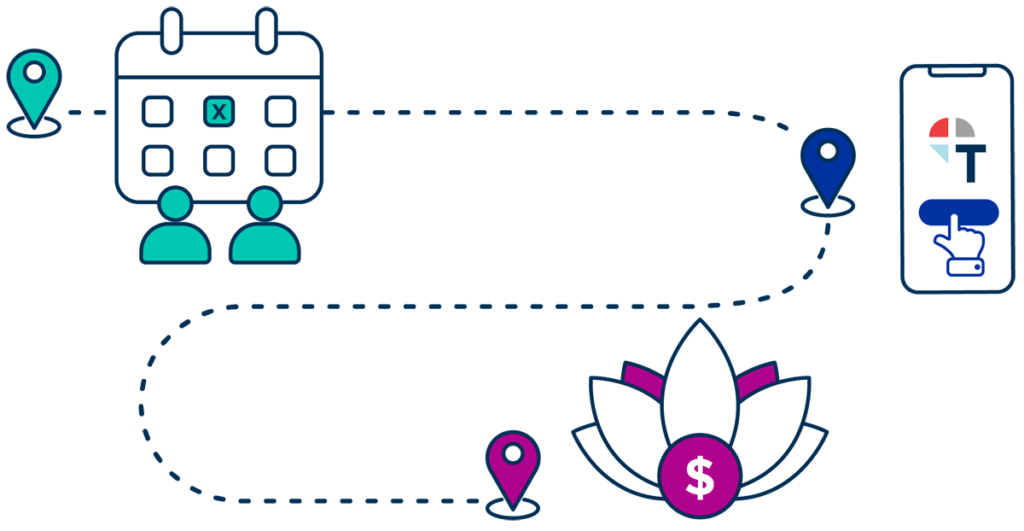

Step 1: A meeting of the minds.

We have a meeting of the minds to understand why you want to engage and what you hope to accomplish.

Step 2: We activate TrustPlus for your employees and provide a suite of communication resources to maximize engagement.

It’s as simple as that.

We’ll provide a custom link for your employees to click to get started via email or text message, along with a suite of communication resources to ensure your employees take full advantage of the often life-changing investment you’re making in their financial health–and in your recruiting, retention, and productivity.

From template language and art to live webinars, brochures, and flyers, every employer’s needs are different. We work with you to identify the most effective mix for engaging your employees.

Step 3: We provide data and insights to help drive ongoing financial health, wellness, and productivity.

We share unique insights into workers’ money worries and provide resources, tools, and recommendations to help you strengthen their financial health to boost productivity and wellness.

TrustPlus for Your Employees

Easy: Getting started is easy. Notice a theme here? There’s no paperwork for employees to fill out. No books to read. No workshops to sit through. Employees can access TrustPlus anytime, anywhere, starting with a single click.

Empowered: TrustPlus clients receive a complete view of their finances and a practical action-plan to achieve their personal financial goals in their first session. Among the most common feedback: I feel empowered with a renewed sense of control over my finances.

Efficient: TrustPlus is designed for today’s changing workforce, accessible 24/7 via mobile phone and computer. Workers can receive financial insights and trusted guidance, on-demand, from the moment they first engage with their TrustPlus Personal Finance Coach.

Start taking control of your finances with one click!

Start taking control of your finances with one click!

Step 1: Click “sign up for TrustPlus” via text message or email.

We provide you with copy, art, and a custom link for your business or organization to send to your employees. All they have to do is click the link which brings them to the sign-up page.

Step 2: Choose a TrustPlus Personal Finance Coach and a time to meet.

With a couple of clicks, employees review the bios of our TrustPlus Personal Finance Coaches, select the expert with whom they’d like to work to strengthen their financial health, and choose a time for their initial session.

Step 3: Craft a Financial Action Plan with your coach (includes ongoing sessions).

TrustPlus Personal Financial Coaches do a deep dive with every client. Together we review their credit report and cash flow, explore dreams, and set actionable goals to achieve them. Personalized on-demand support with resources, strategies, and product recommendations ensure each client has the support they need whenever they need it.