Financial Health and Productivity

TrustPlus resources to support worker financial health

TrustPlus resources to support worker financial health

TrustPlus Financial Coaching Now Available to WorkMoney Members Nationwide

June 2025 Neighborhood Trust Financial Partners and WorkMoney are partnering to bring TrustPlus financial coaching to millions of hardworking families across the country. As a national nonprofit, WorkMoney helps [...]

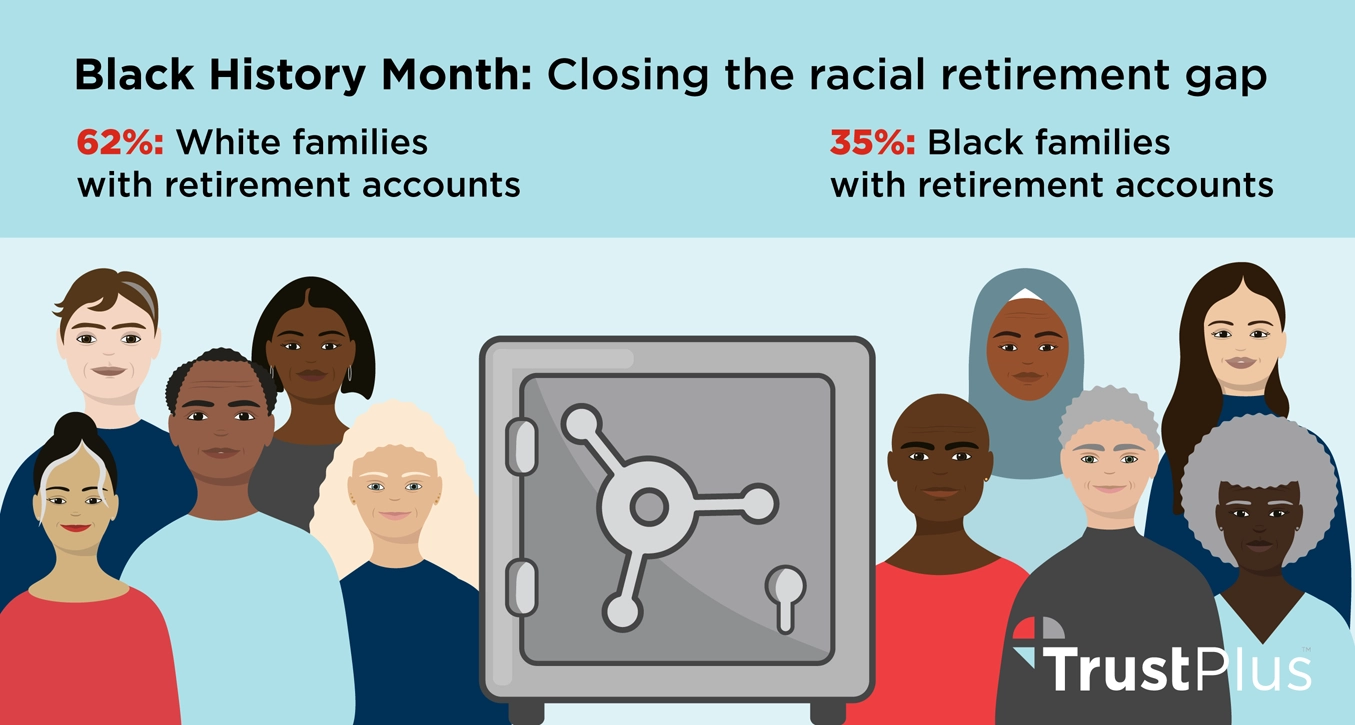

Close the racial retirement savings gap to boost savings overall

The racial retirement savings gap is shocking: 35% of Black families had retirement accounts in 2022 compared to 62% of white families according to the Federal Reserve. Research suggests [...]

Implement emergency savings accounts to boost retirement plan participation rates, savings

Research from Commonwealth and BlackRock’s Emergency Savings Initiative finds that adding emergency savings to retirement savings via an in-plan, after-tax account helps individuals save for emergencies and encourages participation [...]

New free tax filing options: What workers should know

New free tax filing options can save workers money and ease financial stress during tax season. Employers can boost productivity, profits, and impact by sharing information about resources including [...]

Student loan forgiveness: What employers should know, now

Federal student loan forgiveness purgatory trapped millions of workers. They now have a way out, following updated guidance last week from the U.S. Department of Education. The time to [...]

Holiday debt solutions for your workers

Holiday debt drags on wellness, profits, and impact. January is the best time to address it, says TrustPlus Senior Financial Coach Elise Nussbaum, “because that is when we have [...]

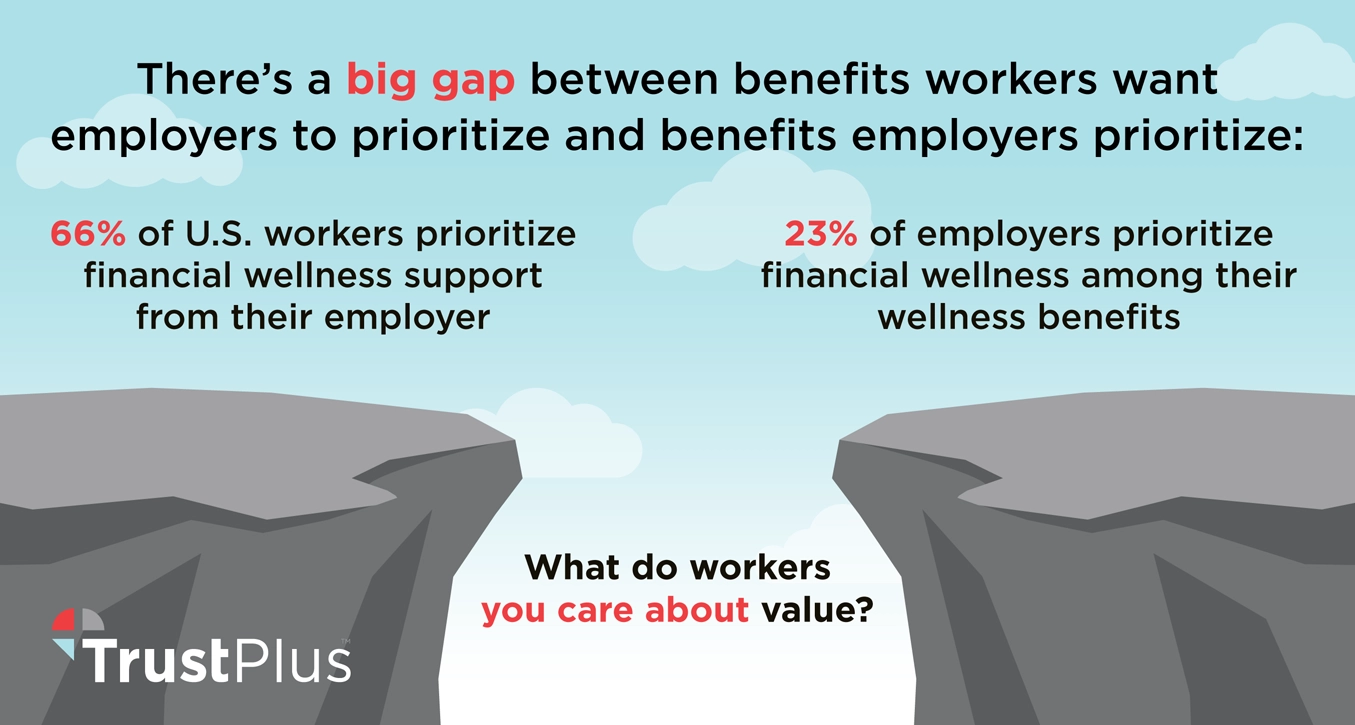

Financial wellness priorities gap costs employers

66% of U.S. workers prioritize financial wellness benefits, yet only 23% of employers prioritize financial wellness as an aspect of their well-being benefits. Looking to strengthen your financial wellness [...]

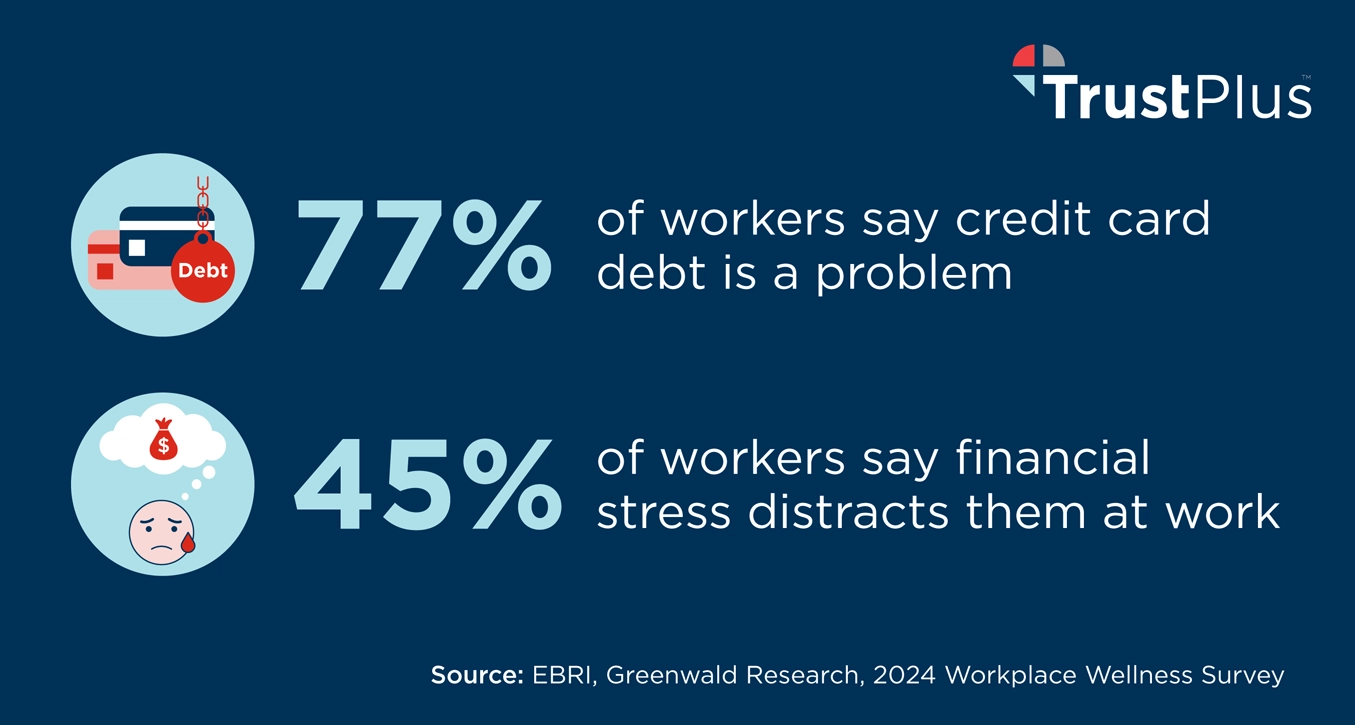

Credit card debt is a problem for 77% of U.S. workers

Credit card debt is rising while 45% of U.S. workers are already distracted by financial stress at work: Why smart employers are turning to financial coaching to boost profits [...]

Minimize debt, stress, among workers this holiday season

Help your people minimize debt to boost profits, productivity, and impact. 58% of U.S. adults say that financial concerns cause them stress over the holidays, the top cited stressor. [...]

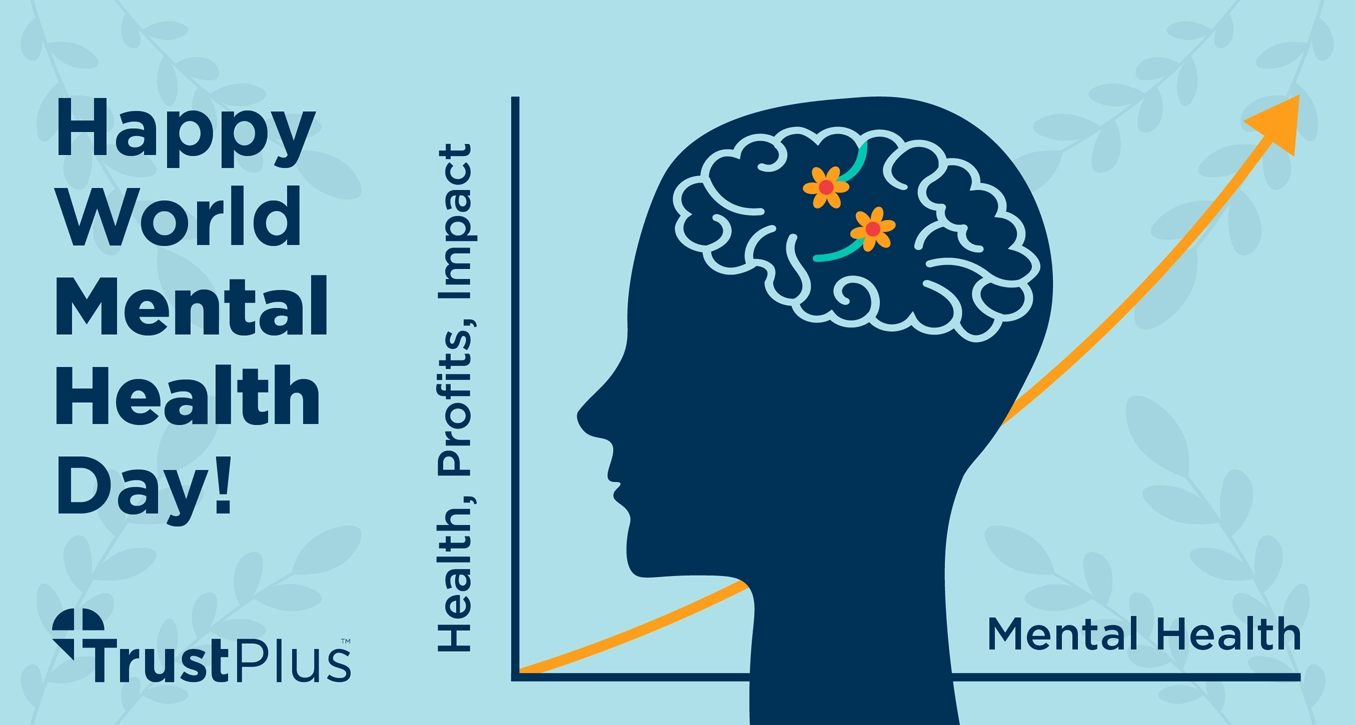

How to reduce debt, boost mental health among workers

Reduce debt among your workers, and your people and your organization will benefit. Financial stress including a high debt-income ratio puts physical and mental health at risk, says Oscar [...]

Debt reduction strategies for workers

Debt reduction eases financial stress, workers’ top stressor overall, and sets them on a path to financial security, boosting profits, impact, and wellness. Borrowing costs are expected to drop [...]

What your workers should know about Buy Now Pay Later

Buy Now Pay Later products are used most by financially insecure workers, which can lead to late payment fees, rising debt and employee financial stress. Here’s what your workers [...]

Student loans repayment “on-ramp” closes on September 30

Workers with federal student loans will then face dings to their credit scores for missed or incomplete payments, for the first time since March 2020, with significant implications for [...]

Understanding debt consolidation loans: A simple guide

Juggling multiple debts from different creditors can be overwhelming and hard to keep track of. If you find yourself in this situation, consider a debt consolidation loan. [...]

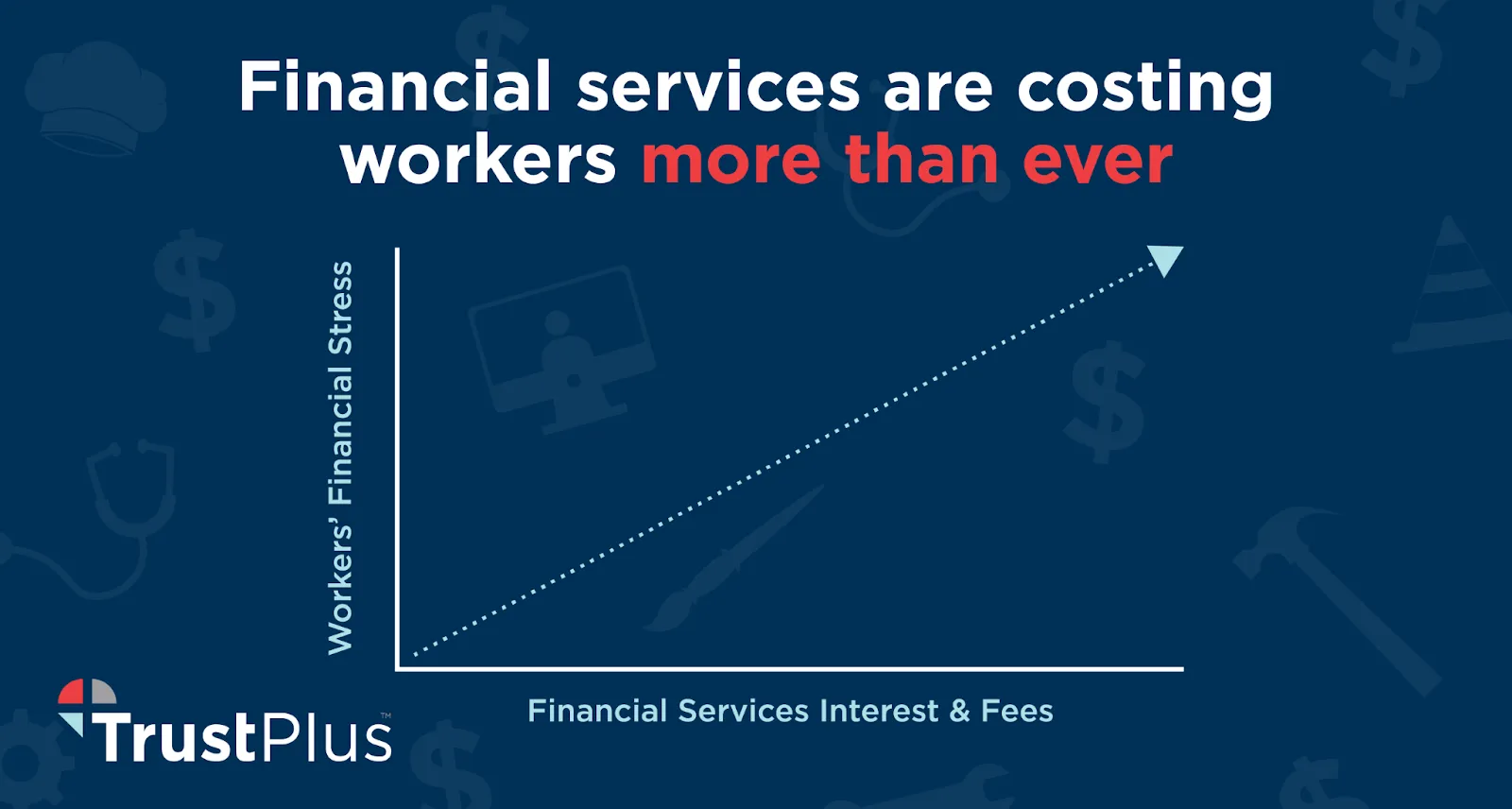

Boost benefits-spend ROI with personal financial coaching

HR leaders looking to boost benefits-spend ROI can solve for workers’ top stressor, personal finances, with a solution as flexible as financial challenges are diverse, amidst all-time high costs [...]

TrustPlus Financial Coaching Now Available to WorkMoney Members Nationwide

June 2025 Neighborhood Trust Financial Partners and WorkMoney are partnering to bring TrustPlus financial coaching to millions of hardworking families across the country. As a national nonprofit, WorkMoney helps [...]

Close the racial retirement savings gap to boost savings overall

The racial retirement savings gap is shocking: 35% of Black families had retirement accounts in 2022 compared to 62% of white families according to the Federal Reserve. Research suggests [...]

Implement emergency savings accounts to boost retirement plan participation rates, savings

Research from Commonwealth and BlackRock’s Emergency Savings Initiative finds that adding emergency savings to retirement savings via an in-plan, after-tax account helps individuals save for emergencies and encourages participation [...]

New free tax filing options: What workers should know

New free tax filing options can save workers money and ease financial stress during tax season. Employers can boost productivity, profits, and impact by sharing information about resources including [...]

Student loan forgiveness: What employers should know, now

Federal student loan forgiveness purgatory trapped millions of workers. They now have a way out, following updated guidance last week from the U.S. Department of Education. The time to [...]

Holiday debt solutions for your workers

Holiday debt drags on wellness, profits, and impact. January is the best time to address it, says TrustPlus Senior Financial Coach Elise Nussbaum, “because that is when we have [...]

Financial wellness priorities gap costs employers

66% of U.S. workers prioritize financial wellness benefits, yet only 23% of employers prioritize financial wellness as an aspect of their well-being benefits. Looking to strengthen your financial wellness [...]

Credit card debt is a problem for 77% of U.S. workers

Credit card debt is rising while 45% of U.S. workers are already distracted by financial stress at work: Why smart employers are turning to financial coaching to boost profits [...]

Minimize debt, stress, among workers this holiday season

Help your people minimize debt to boost profits, productivity, and impact. 58% of U.S. adults say that financial concerns cause them stress over the holidays, the top cited stressor. [...]

How to reduce debt, boost mental health among workers

Reduce debt among your workers, and your people and your organization will benefit. Financial stress including a high debt-income ratio puts physical and mental health at risk, says Oscar [...]

Debt reduction strategies for workers

Debt reduction eases financial stress, workers’ top stressor overall, and sets them on a path to financial security, boosting profits, impact, and wellness. Borrowing costs are expected to drop [...]

What your workers should know about Buy Now Pay Later

Buy Now Pay Later products are used most by financially insecure workers, which can lead to late payment fees, rising debt and employee financial stress. Here’s what your workers [...]