Juggling multiple debts from different creditors can be overwhelming and hard to keep track of. If you find yourself in this situation, consider a debt consolidation loan.

By Denae Hannah, Senior Financial Coach, TrustPlus, AFC®, CFEI® and Tamika Howell, Financial Coach, AFC®

In today’s world, many people face financial challenges that lead to relying on debt just to make ends meet.

Juggling multiple debts from different creditors can be overwhelming and hard to keep track of.

If you find yourself in this situation, a debt consolidation loan might be a solution worth considering.

What is debt consolidation?

Debt consolidation is a way to simplify your finances by combining all your debts into one single payment each month.

Instead of managing several payments with different due dates and interest rates, you can consolidate them into a single loan with a potentially lower interest rate, saving you time and money.

Is debt consolidation right for you?

Before deciding if debt consolidation is the right choice, it’s important to take a close look at your financial situation.

Ask yourself why you accumulated debt — is it from ongoing expenses or unexpected large purchases?

If you don’t address the root cause of your debt or continue to use credit cards after consolidating, you could end up in the same financial situation again.

Creating a budget can help you see if there’s any extra money each month that could go towards paying off debt.

If you need support deciding, schedule a call with a Financial Coach.

What is a debt consolidation loan?

A debt consolidation loan is taking out a new loan to pay off other existing loans or credit cards.

Debt consolidation loans often have fixed interest rates and can be obtained from banks, credit unions, or private lenders.

They are suitable if you owe a larger amount, usually over $10,000, it’s possible to apply for a loan for a smaller amount.

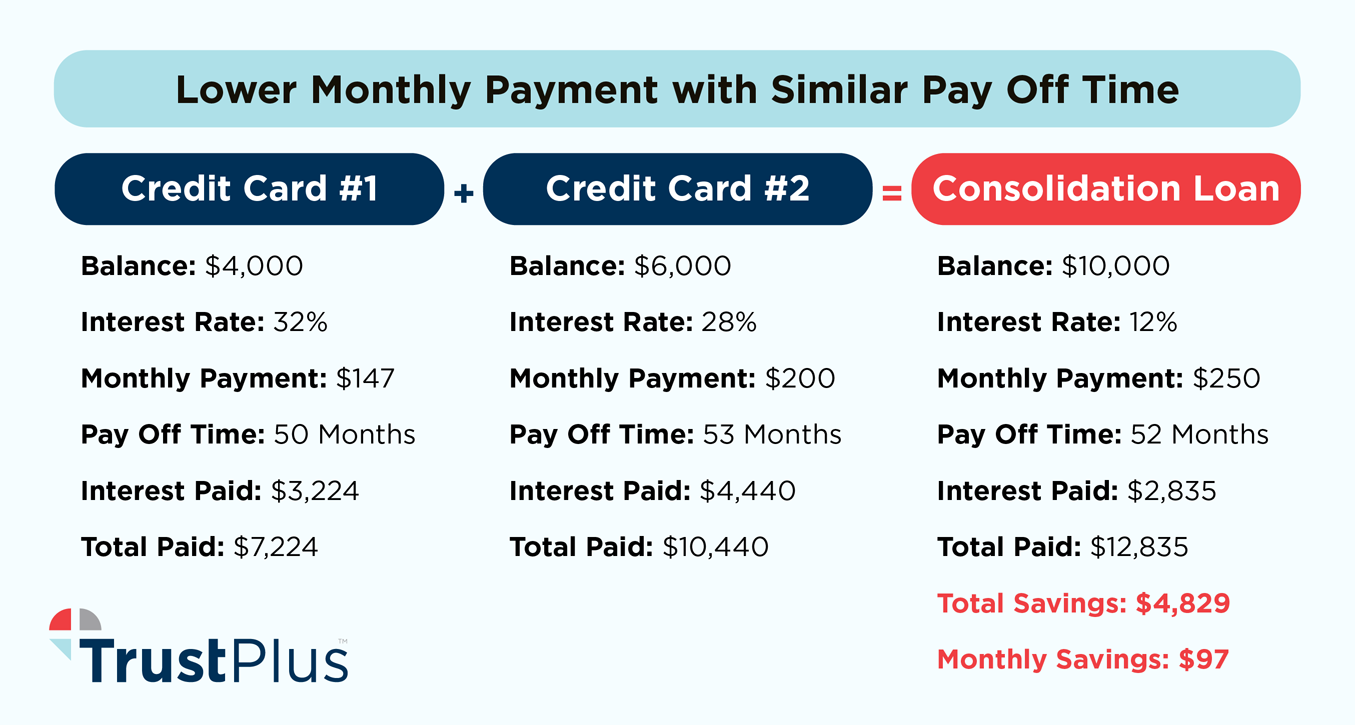

Below are two examples of how a debt consolidation loan could help to reduce your debt.

In the first example, the borrower continues to pay the same amount per month as before the consolidation loan but will be debt free roughly a year sooner:

In the second example, the borrower pays $97 fewer dollars per month than before the consolidation loan and will be debt free in about the same time as if they had not consolidated their debts:

Conclusion

In conclusion, a debt consolidation loan can be a helpful tool to simplify your finances and potentially lower your interest payments.

However, it’s essential to assess your financial habits and consider all options before making a decision.

Remember, the goal is not just to manage debt, but to work towards financial stability and freedom.

Schedule a time to speak with TrustPlus to discuss strengthening the financial health of your workers.