23 Dec Financial wellness priorities gap costs employers

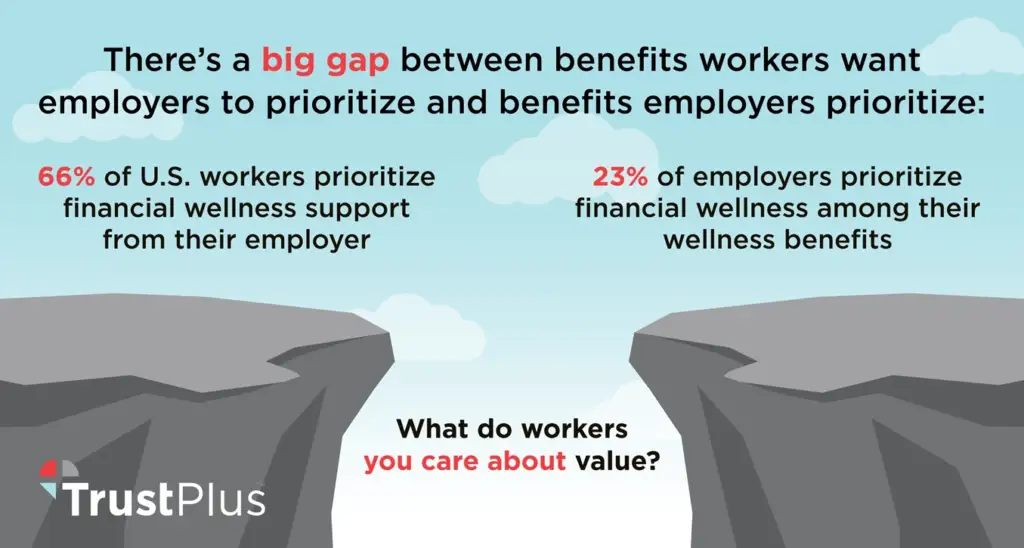

66% of U.S. workers prioritize financial wellness benefits, yet only 23% of employers prioritize financial wellness as an aspect of their well-being benefits. Looking to strengthen your financial wellness benefits in 2025 to align with workers’ priorities? Here are five things you and your workers should know going into the new year.

U.S. workers prioritize financial wellness benefits, according to the 2024 Global Benefits Attitudes Survey from Willis Towers Watson, 66% of them.

Yet only 23% of employers prioritize financial wellness as an aspect of their well-being benefits.

Financial wellness beats out all other well-being subcategories, from supportive company culture, and mental, emotional, and physical health benefits, to workplace connections, per the survey.

This gap between what employers are prioritizing when it comes to spending on your well-being benefits and what workers want is costing your organization profits and impact.

Financial stress is the top stressor overall among workers.

If you’re not solving for financial stress with your well-being benefits then you’re missing out on the opportunity to supply what your workers demand.

And that’s a recipe for wasting your scarce well-being benefits resources on things that don’t matter to your people.

Looking to strengthen your financial wellness benefits in 2025 to align with workers’ priorities?

Here are five things you and your workers should know going into the new year.

(Read: Minimize debt, stress, among workers this holiday season)

Delinquent student loan reporting starts in January

Delinquent student loan payments will start showing up on credit reports as early as January 2025.

Workers should know:

It’s the end of the road or in this case the end of the federal student loan repayment “on ramp.”

Starting next month, the U.S. Department of Education is required to report to credit bureaus after 90 days of non-payment.

That means that if you haven’t made federal student loan payments since October, your credit score could soon suffer.

If you haven’t been making payments:

- The delinquent payments will start showing up on your credit report as early as January 2025.

- Payments that are 30 days late can lower your credit score by as many as 100 points.

- The longer the payment is overdue, the greater the impact on your score.

- If your loan continues to be delinquent, the loan may go into default.

- According to the U.S. Department of Education, delinquent loans will enter into default in late 2025.

- Default can lead to your wages or public benefits being garnished or taken to repay the debt.

For more information, including options for managing your student loans, see this US Department of Education Blog Post.

401(k) takes on student loan debt

Sponsors of 401(k), 403(b), governmental 457(b) plans, and savings incentive match plans for employees of small employers (SIMPLE plans) can now make matching contributions to employees’ qualified student loan payments (QSLPs) as if they were pretax, Roth or after-tax contributions.

2024 is the first year the student loan match is possible under the massive retirement legislation Secure 2.0 passed at the end of 2022.

Under Secure 2.0, employers can also offer the QSLP match even if employees aren’t contributing to a plan.

Here’s to eliminating the toxic choice employees are often forced to make between investing in retirement and paying down student loan debt.

401(k) takes on emergency savings

Emergency savings and making it to the next paycheck now reign supreme as top stressors among workers.

Your 401(k) plan can now help.

Sponsors of 401(k), 403(b) and governmental 457(b) plans can now offer non-highly compensated employees pension-linked emergency savings accounts, under Secure 2.0.

Savvy employers are doing a deep dive on how to roll out emergency savings and student loan benefits made possible through 401(k), 403(b) and governmental 457(b) plans under Secure 2.0.

At the same time, new questions arise as these new provisions are beginning to be implemented and felt throughout workplaces nationwide.

Is the 401(k) doing too much?

The 401(k) taking on student loans and emergency savings could lead to unintended, negative, consequences, says Richard Kaplan, author of “Analyzing the New Planning Opportunities in Secure 2.0 for Retirement Plan Participants.”

Chair of the University of Illinois College of Law and a fellow at the Employee Benefits Research Institute, Kaplan worries about the “overloading” of these accounts.

“When you’ve created all these potential options to take money out of the 401(k), don’t be terribly surprised that people reach retirement and not much is there,” Kaplan tells Nathan Place of Financial Planning. “Or certainly not as much is available there, because they had more immediate needs, and that was allowed by the law.”

Stakeholders will be watching closely as this plays out over the long term.

In the immediate term, smart employers recognize that your benefits mix must prioritize financial wellness. And that financial wellness spans reducing debt from student loans to building savings for emergencies and retirement, and beyond.

The 401(k), 403(b), and governmental 457(b) under Secure 2.0 now offer employers options to address all of the above, and, as every employer will tell you: options are good.

Which brings us to personal financial coaching that enables employers to allocate your scarce benefits resources to a solution as personal and flexible as your people’s financial stressors are specific and diverse.

Personal financial coaching offers holistic solution

Personal financial coaching addresses all financial stress in a way that FinTech apps, financial literacy training, and financial literacy workshops can’t.

“One-size-fits-all financial education has little to no effect on changing real-world financial behaviors. A meta-analysis of more than 200 studies found that educational interventions explained only 0.1% of the financial behaviors studied.”

As TrustPlus financial coaches know well, money is personal, which is why smart employers are investing in personal financial coaching.

You know what your people prioritize and understand that solving for their top stressor is smart leadership.

Schedule time with TrustPlus to discuss financial wellness and easing financial stress among your people.