TrustPlus supplies the human connection that drives real impact

Financial stress hampers worker health and productivity, which has a significant impact on your organization’s bottom line. Our customers need a proven solution to take action, which is where TrustPlus comes in. Our Financial Coaches and digital products help workers reduce debt, improve credit, and strengthen their overall financial health—confidentially and at no cost to them.

In addition, through partnerships with fintechs, we ensure our service is innovative and always evolving for the better. Our holistic approach pairs human guidance and technology, paving the way for our customers and the workers they serve or employ to experience the benefits of financial health.

TrustPlus supplies the human connection that drives real impact

Financial stress hampers worker health and productivity, which has a significant impact on your organization’s bottom line. Our customers need a proven solution to take action, which is where TrustPlus comes in. Our Financial Coaches and digital products help workers reduce debt, improve credit, and strengthen their overall financial health—confidentially and at no cost to them.

In addition, through partnerships with fintechs, we ensure our service is innovative and always evolving for the better. Our holistic approach pairs human guidance and technology, paving the way for our customers and the workers they serve or employ to experience the benefits of financial health.

Invest in worker financial health with TrustPlus today.

Realize the gains in physical and mental health, retention, and recruitment.

Receive data insights to drive ongoing value, health and productivity.

How It Works

For Employers

We make it easy to help your employees ease the stress of the everyday money worries that hamper wellness and productivity. As long as they have a phone or internet connection, our TrustPlus Financial Coaches can help them strengthen their credit, optimize debt, and build savings while maximizing the benefits you already offer.

For Financial Institutions

Your customers and members get trusted, human-touch financial coaching that complements your suite of products and services. Our Financial Coaches provide judgment-free guidance to help them reduce debt, improve credit, and reach their financial goals—strengthening their relationship with your institution and driving measurable results for your bottom line.

In Their Words

Hear from our clients and Financial Coaches as they share their experiences with TrustPlus, what happens during a session, and why they exude passion for this service.

Insights

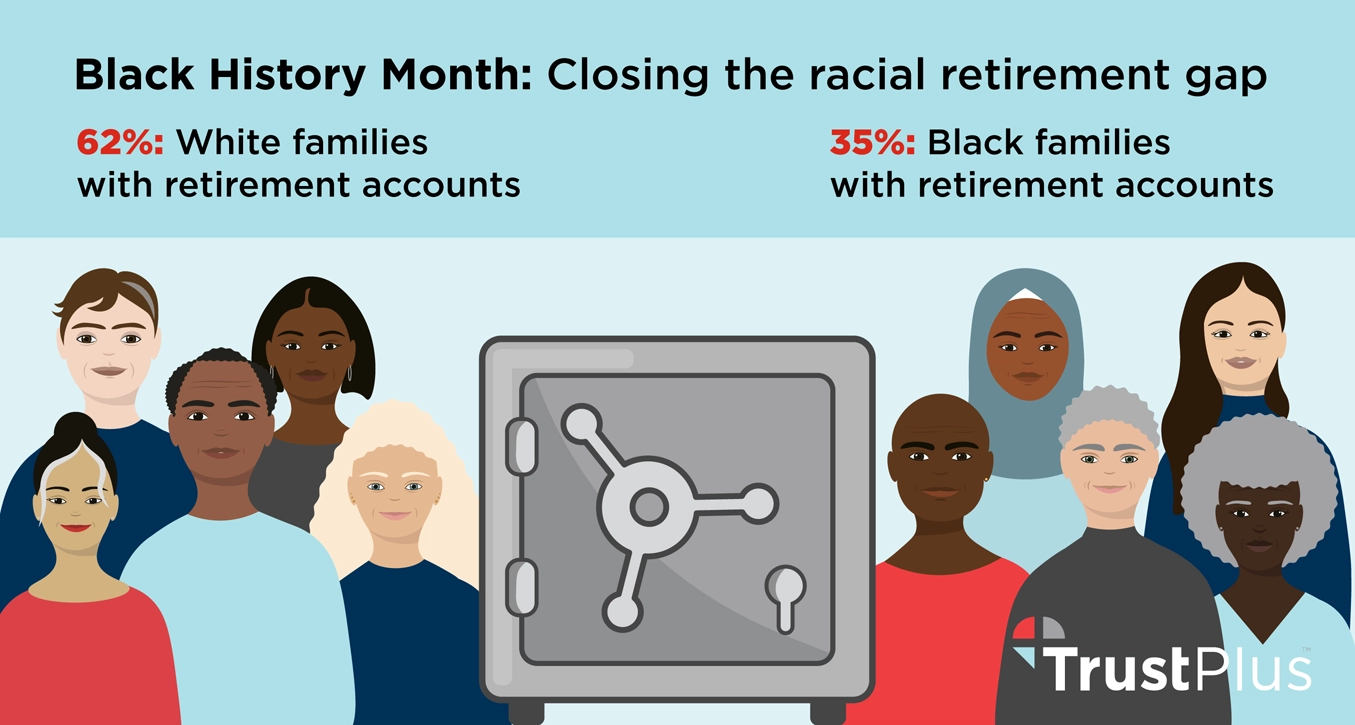

Close the racial retirement savings gap to boost savings overall

The racial retirement savings gap is shocking: 35% of Black families had retirement accounts in 2022 compared to 62% of white families according to the Federal Reserve. Research suggests [...]

Implement emergency savings accounts to boost retirement plan participation rates, savings

Research from Commonwealth and BlackRock’s Emergency Savings Initiative finds that adding emergency savings to retirement savings via an in-plan, after-tax account helps individuals save for emergencies and encourages participation [...]

New free tax filing options: What your workers should know

New free tax filing options can save workers money and ease financial stress during tax season. Employers can boost productivity, profits, and impact by sharing information about resources like [...]

Invest in Worker Financial Health

Financial stress hampers worker productivity and physical health and adds to mental health challenges. It leads to higher rates of turnover.

TrustPlus Personal Financial Coaches work one-on-one with workers on an ongoing basis to reduce financial stress by optimizing debt, strengthening credit, and building savings.

As a nonprofit social enterprise, we’re objective, expert guides motivated solely by worker financial health. Whether you’re looking to enhance recruiting and retention, reduce worker stress and absenteeism, or improve mental health and the bottom line, TrustPlus is the solution for you.

Schedule a callOr email us with questions today

Schedule a callOr email us with questions today

Invest in Worker Financial Health

Financial stress hampers worker productivity and physical health and adds to mental health challenges. It leads to higher rates of turnover.

TrustPlus Personal Financial Coaches work one-on-one with workers on an ongoing basis to reduce financial stress by optimizing debt, strengthening credit, and building savings.

As a nonprofit social enterprise, we’re objective, expert guides motivated solely by worker financial health. Whether you’re looking to enhance recruiting and retention, reduce worker stress and absenteeism, or improve mental health and the bottom line, TrustPlus is the solution for you.

Schedule a callOr email us with questions today

Who We Are

About Neighborhood Trust

Neighborhood Trust is a financial services innovator, making financial security possible for all workers.

Meet Our Team

Get to know the financial health experts and passionate social entrepreneurs who are strengthening worker financial health nationwide.

Select Customers and Partners

Select Customers and Partners

Select Customers and Partners