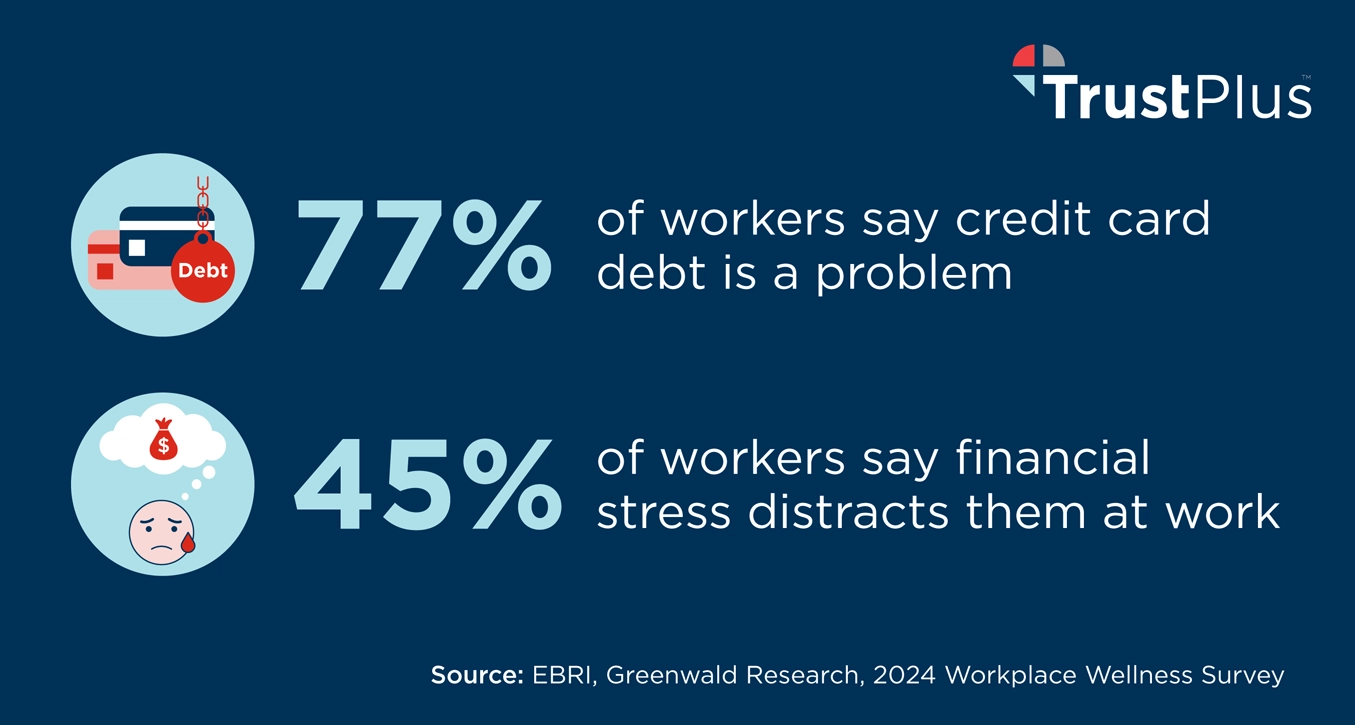

Credit card debt is rising while 45% of U.S. workers are already distracted by financial stress at work: Why smart employers are turning to financial coaching to boost profits and impact.

Credit card debt is a problem for 77% of U.S. workers, finds the 2024 Workplace Wellness Survey from Employee Benefit Research Institute and Greenwald Research (press release, report summary).

“Credit card debt is cited as the biggest problem, like prior years — with a quarter having at least $10,000 in debt.”

Increasingly, workers are using their credit cards to purchase necessities not luxuries.

“About eight in 10 workers report keeping discretionary spending to a minimum or budgeting for it to ensure that they can afford it.”

Meanwhile: “Half of those who say credit card debt is a problem report that groceries and vehicle expenses contributed to the debt.”

And half say housing costs cause them the most stress; almost as many say groceries.

In other words, workers are experiencing financial stress around food, shelter, and making it to the next paycheck, in the present.

And a vast majority of workers are also stressing about how they’re going to survive in the future or amidst an unexpected expense:

3 in 4 workers “agree thinking about their financial future makes them feel stressed; seven in 10 agree their lack of emergency savings stresses them.”

It’s financial stress that’s taking a toll on their work and on your organization.

Nearly half of workers say they’re distracted by financial stress on the job, 45%.

Read: Tips for paying off credit card debt

Employee financial stress costs employers, employees

This financial stress among workers costs employers money and impact, and employees their health.

Given these connections, smart employers are taking seriously the idea that employee financial stress is a solvable problem, with a data-informed eye on what matters to people: 1×1 financial coaching.

Think relationship, ongoing, human, personal, because money is personal.

As is financial stress and its impacts on employee health and wellness, and on your bottom line.

We certainly know what doesn’t matter to people: financial literacy, alone.

Financial literacy alone isn’t enough

Financial literacy alone isn’t enough.

Impersonal financial workshops and apps do little to change financial behavior:

“One-size-fits-all financial education has little to no effect on changing real-world financial behaviors. A meta-analysis of more than 200 studies found that educational interventions explained only 0.1% of the financial behaviors studied,” finds Martha Menard.

A TrustPlus financial coach is an on-demand advocate and expert guide who helps your people vanquish debt and build savings for emergencies and retirement.

Whatever the financial stressor, from student, medical, credit card and auto debt to stretching paychecks and getting out of predatory products, TrustPlus financial coaches solve for it. All the while ensuring your people are maximizing the benefits you already offer.

Think of TrustPlus as a personalized financial wellness solution that offers peace of mind to every worker you care about, regarding their top stressor overall.

Financial wellness benefits = 1×1 financial coaching

Financial wellness benefits should include 1×1 financial coaching.

Otherwise, your organization risks wasting money on financial wellness benefits that research suggests won’t work.

1×1 financial coaching provides workers with the tools to reduce the financial stress that hinders productivity and wellness and, vitally, with the ongoing support necessary to use these tools to maximum effect.

TrustPlus is the link between knowledge and action.

And the results are life changing for people and for organizations.

For employers looking to boost profits, impact, retention and productivity, financial coaching can be a key catalyst for improvement.

Personal financial coaching for workers

The virtue of personal financial coaching for workers is that it is tailored to each member of your team.

Personal financial coaching solves for their diverse individual challenges amidst systemic ones like inflation, high interest rates, and the rising costs of financial services themselves.

Employers who prioritize 1×1 financial coaching prioritize what data are telling us about reducing employee financial stress and creating a supportive culture where people can thrive.

And when your people thrive, your organization thrives.

It’s called smart leadership.

Schedule a time with TrustPlus to discuss personal financial coaching for your people.