TrustPlus articles that generated the most engagement in 2023 offer a window into what’s of most interest to employers when it comes to the latest research, news, and best practices in financial wellness initiatives.

‘Tis the season for annual reviews!

Our four TrustPlus blog posts that generated the most engagement in 2023 offer a window into what’s of most interest to employers when it comes to the latest research, news, and best practices in financial wellness initiatives.

They also hint at what’s to come in 2024, a year that’s shaping up to be defined by growing financial insecurity among employees and the growing realization among employers that it’s in your interest to explore financial coaching, not just DIY resources, for your workforce.

Because, as we know, financial literacy, alone, is not enough:

“One-size-fits-all financial education has little to no effect on changing real-world financial behaviors. A meta-analysis of more than 200 studies found that educational interventions explained only 0.1% of the financial behaviors studied,” found Martha Menard.

Money is personal which is why employers who are motivated to help solve for employee financial stress need a personal solution.

Employers increasingly understand this, and the fact that employee financial stress not only hampers individual employee wellness including mental and physical health but productivity, profits, and organizational performance, too.

So, what’s an employer to do? We offer a few recommendations for employers from our top-performing blog posts of 2023.

1) Financial stress distracts majority of workers on the job

Household bills and a lack of emergency savings replaced retirement savings for the first time as the top financial stressor in the fourth annual Workplace Wellness Survey from the Employee Benefit Research Institute and Greenwald Research, while a majority of employees struggle with caregiving responsibilities.

Explore emergency savings benefits under Secure 2.0.

Given that the primary financial stress factor for employees is now a lack of emergency savings and simply being able to pay day-to-day household bills, smart employers are exploring emergency savings benefits for workers made possible under Secure 2.0. The historic law intended to boost retirement savings nationwide provides defined contribution plan sponsors a new way to help employees save for emergencies. Sponsors of 401(k), 403(b) and governmental 457(b) plans can offer non highly compensated employees pension-linked emergency savings accounts in plan years beginning after December 31, 2023. Employees would contribute to these accounts on a Roth basis and could make withdrawals as frequently as monthly.

Explore paid family leave as a net positive for employers.

Stanford Scholar Maya Rossin-Slater says there’s “quite a bit of evidence that paid family leave is beneficial for family health and well-being outcomes, in terms of infant and maternal health and overall financial stability, especially in low-income families.” Better yet for cost-conscious employers, Rossin-Slater et al in a study for the National Bureau of Economic Research found no indication that paid family leave was burdensome for businesses. They did find “an increase in average ratings of employee commitment and cooperation, as well as an increase in their rating of the ease of handling lengthy worker absences.”

Explore childcare benefits (as a cost saver?!).

Prior to the onset of the pandemic, inadequate childcare was costing working parents $37 billion a year in lost income and employers $13 billion a year in lost productivity.

During the pandemic, working parents lost eight hours per week on average due to a lack of childcare. Combining reported hours lost for the individual as well as their spouse/partner, researchers writing in Harvard Business Review found an even greater loss of 14.6 hours per week. “This is similar in magnitude to the loss of hours due to staff reductions, loss of business, or lack of remote work available.”

Smart employers recognize the rising financial challenges facing workers nationwide, especially caregivers, and are augmenting their benefits packages accordingly.

2) What workers should know about student loan payments

43.5 million federal student loan borrowers were responsible for payments for the first time in three years starting in October. Smart employers are providing workers with information and resources to ensure that financial stress from the end of the federal student loan moratorium doesn’t hurt the health or job performance of your workforces.

As employers look for ways to attract and retain talent, offering student loan repayment assistance is one powerful way to differentiate yourself, demonstrate leadership, support equity, and strengthen your organization.

Recommendations for employers:

Explore matching student loan repayments under Secure 2.0.

Employers will be able to make a contribution to an employee’s retirement account based on the amount they paid toward their student loan balance. Under the new law, sponsors of 401(k), 403(b), governmental 457(b) plans, and savings incentive match plans for employees of small employers (SIMPLE plans) can make matching contributions to employees’ qualified student loan payments (QSLPs) as if they were pretax, Roth or after-tax contributions.

For plan years starting after December 31, 2023, employers can offer the QSLP match even if employees aren’t contributing to a plan, making it possible for employers to eliminate the toxic choice employees often make between investing in retirement and paying down student loan debt.

And, even if student loan repayment assistance is out of the question at the moment, simply sharing information and resources about student loans demonstrates to your workers that you understand their challenges and care about their wellbeing, which has its own benefits.

Per Gallup, employees who strongly agree that their employer cares about their overall wellbeing are 69% less likely to actively search for a new job, 71% less likely to report experiencing a lot of burnout, and three times more likely to be engaged at work.

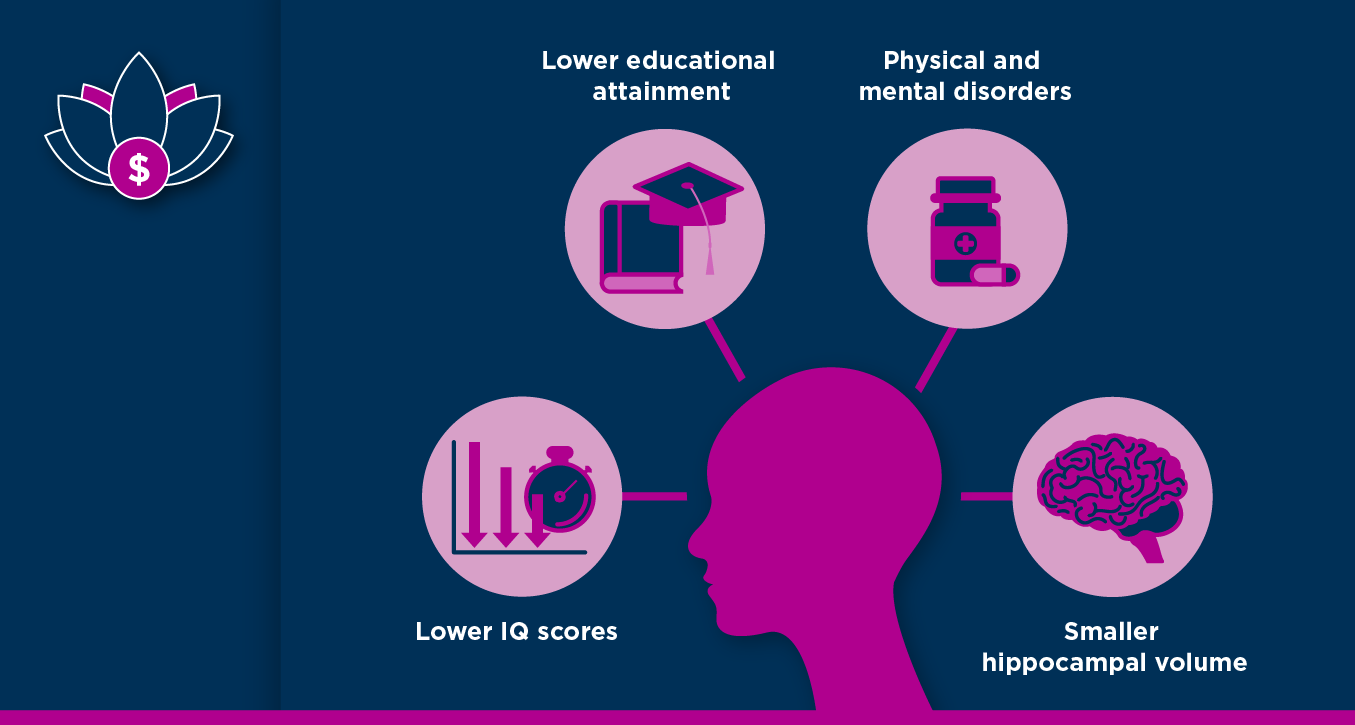

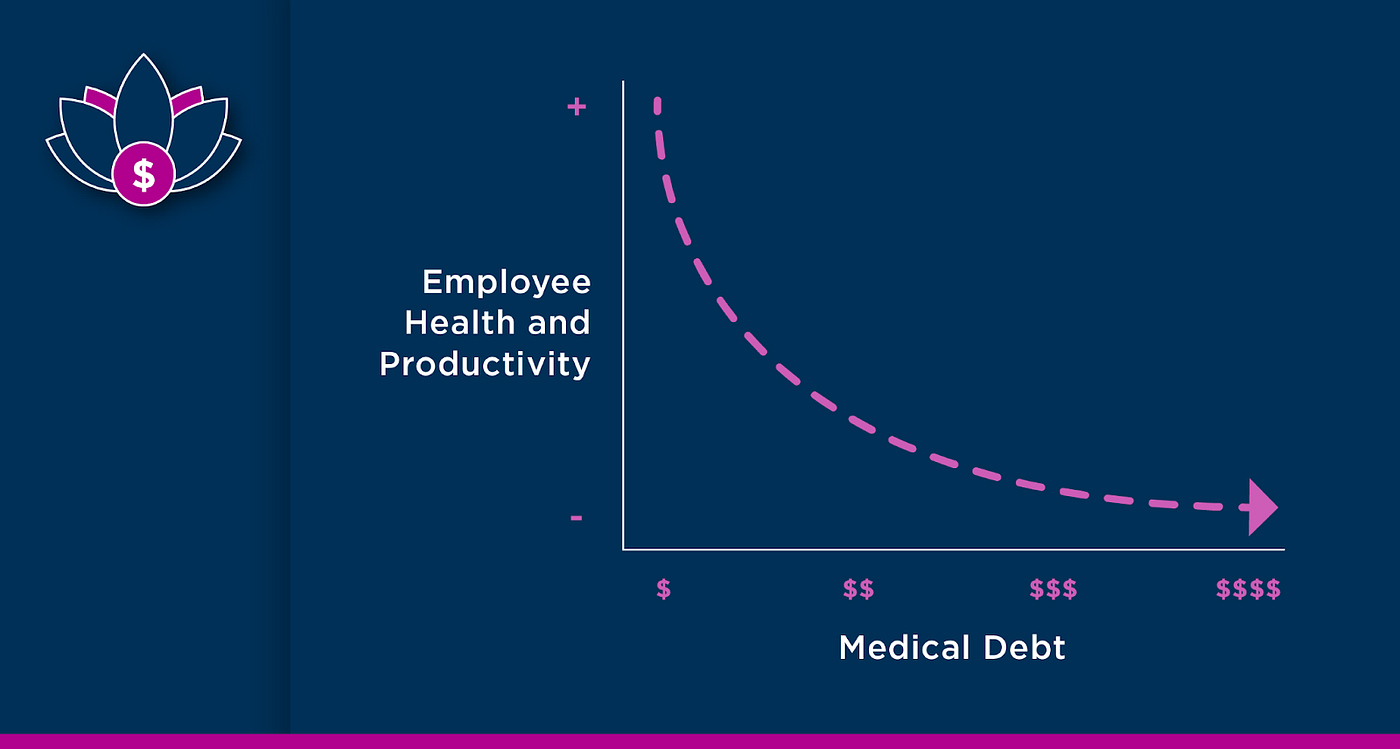

3) Medical debt is a growing problem for workers

Alarming results of research from Neighborhood Trust Financial Partners and RIP Medical Debt suggest workers with employer-provided health insurance “still reported high rates of medical debt (70%), risk of accruing future medical debt (40%), and stress due to medical debt (40%).”

“Insurance Alone is Not Enough” draws on the experiences of TrustPlus clients and RIP Medical Debt beneficiaries, adding to a growing body of research which suggests medical debt is a pervasive problem for the majority of U.S. workers.

The brief elucidates why insurance is not enough on its own to prevent medical debt or its negative impacts on your business and workers, offering the following recommendations:

Tap workers’ insights.

The authors suggest starting with a survey of your own employees or focus groups to understand to what degree they’re struggling with medical debt; ask them what would be most helpful to them.

Provide prorated employer premium subsidies to enhance equitable outcomes.

Offer a benchmark dollar amount for what someone with the same health background and demographics as a given employee typically spends on healthcare annually.

Provide the option to easily adjust HSA contributions per paycheck.

Create a hardship fund.

Hardship funds have demonstrated benefits for beneficiaries and for nonbeneficiaries who feel supported knowing it’s there if they need it.

4) 6 Steps to boost productivity and reduce employee stress this tax season

Michael McKee, former president of the U.S. branch of the International Stress Management Association: “Money is a major source of stress on people, and what tax season does is shine a great big spotlight on the issue.” Employers are in a unique position to help workers reduce stress during tax time which can boost productivity, mental health and wellness.

40% of Zoomers and 46% of millennials say they rely on their tax refunds to make ends meet per a recent Credit Karma/Qualtrics survey. Translation: tax returns are a big deal for many of your employees. Here are six steps you can take to boost employee productivity and reduce stress this tax season.

Over-communicate about W2s.

Communicate to your employees that W2 forms have been distributed. Remind them that it’s available, and avoid mailing if possible. Post on your company Intranet in a clear, visible place.

Set automated reminders.

“Did you file? The deadline this year is April 18.

Inform about Volunteer Income Tax Assistance (VITA).

The IRS’ Volunteer Income Tax Assistance (VITA) program offers free tax preparation help to workers who generally make $60,000 or less, persons with disabilities, and limited English-speaking taxpayers. They can find a VITA site on the IRS website and also take advantage of free online tax filing services available on the IRS website.

TrustPlus Personal Finance Coach Ashley Hannah here offers a detailed, step-by-step, guide to finding your local VITA site.

Dispel myths and educate.

Even after years of filing, many employees are still unaware of most key deductions as well as many of the most common tax rules. You can help by sending trusted resources and tips. For example, a way to save on taxes could be through HSA’s tax benefits. Plus, you can even pre-schedule follow-up tips after tax season to keep your employees engaged and thinking of their finances ahead of time.

Remind them not to leave money on the table.

Your employee could benefit from the Earned Income Tax Credit (EITC), a benefit for working people with low to moderate-income, particularly those with children. Only about 78 percent of people who are eligible for EITC actually utilize it, so if they are eligible let them know so they don’t miss out.

Show them you’re here to help.

Schedule a meeting (Lunch & Learn, anyone?) with your team to talk about tax season or hold tax season office hours. Everyone’s in the same boat and needs to file taxes. Remind your employees that you are a resource if they have any questions.

Schedule a time to speak with TrustPlus about how we can help your business or organization capture the benefits of a financially healthy workforce.