Medical debt has negative and compounding impacts on the financial, mental and physical health of low- to moderate- income workers, finds new research from Neighborhood Trust Financial Partners and RIP Medical Debt.

Medical debt has negative and compounding impacts on the financial, mental and physical health of low- to moderate- income workers, finds the latest research from Neighborhood Trust Financial Partners and RIP Medical Debt.

“The Negative Impact of Medical Debt on Overall Health” is the second brief in a multiphase effort by the financial services innovator and medical debt nonprofits to raise national awareness of the problem and identify solutions.

It offers employers recommendations for improving employee financial health and mitigating the negative impacts of medical debt on workers, which has the added benefit of strengthening organizational performance. Think profit, productivity, impact, retention, recruiting.

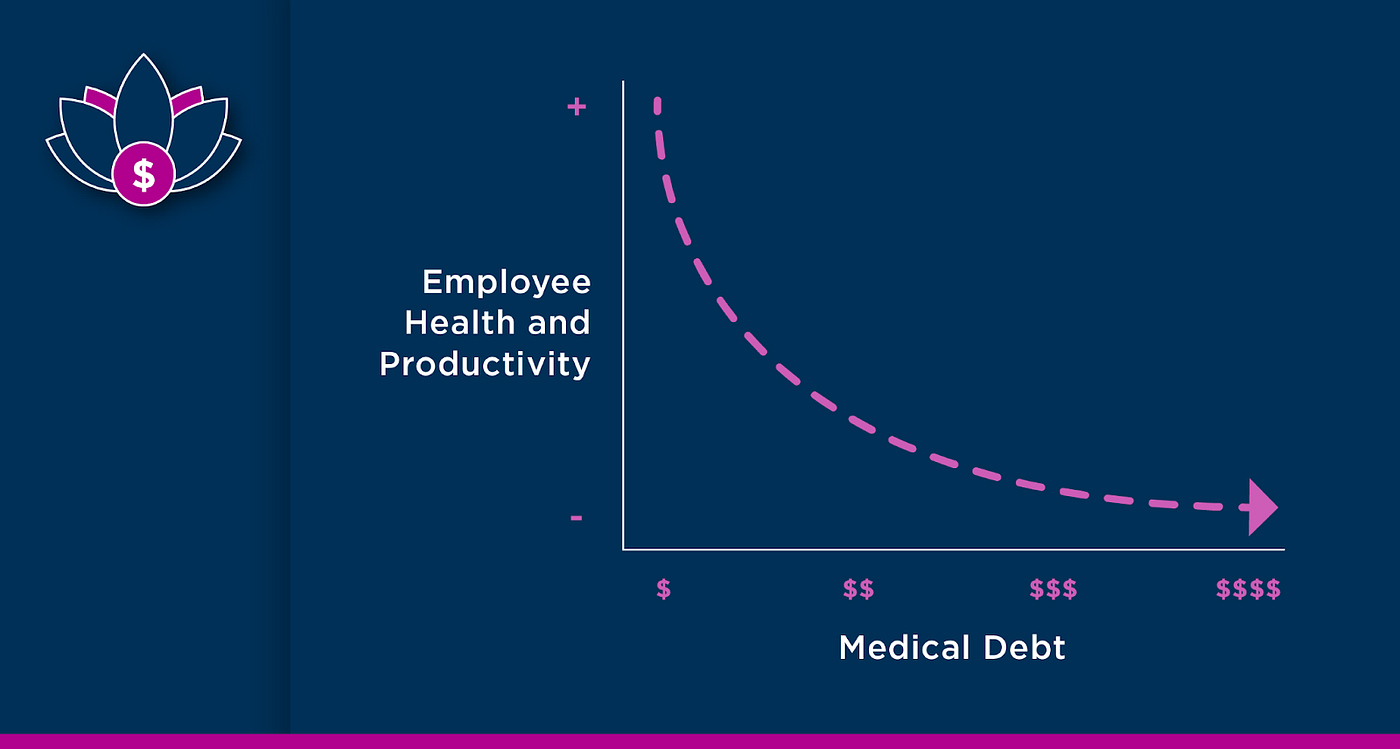

As the brief notes, medical debt and its ripple effects on financial, mental and physical health are not only detrimental to workers’ well-being but are also shown to reduce workplace productivity, so there’s a business case for employers investing in solutions to this growing problem, plus, “employees who feel cared for by their employer are more likely to feel positively about their job, feel engaged at work, be more loyal, and be more productive.”

The growing medical debt problem has also captured the attention of state lawmakers in more than a dozen states, who, as Dan Goldberg of Politico reported this month, “have enacted a variety of consumer protections to mitigate or forestall medical debt” in the absence of federal consensus and in anticipation of congressional inaction. “Several more bills are being debated in the coming weeks, expected to be signed later this year and taken up when sessions reconvene in 2024.”

So, employers, you’re not alone in recognizing medical debt as a growing problem, and at least at the state level in pockets of the country, help could be on the way from a policy perspective.

From a workplace perspective, here are the key findings and recommendations for employers from “The Negative Impact of Medical Debt on Overall Health.”

Key Findings

Medical debt negatively impacted respondents’ financial health: Among the 70% of respondents with current medical debt:

- 57% reported cutting back spending on food, clothing, or basic household items as a result of their medical debt.

- 56% reported that their medical debt negatively affected their plans for the future.

- 39% reported borrowing money from friends or family as a result of their medical debt.

- 27% reported an impact on their access to housing (rental or ownership).

Medical debt negatively impacted respondents’ mental health: Among those with current medical debt:

- 60% reported that their medical debt negatively affected their mental health.

- 42% reported that it negatively affected their self-worth.

- 21% reported that it negatively affected their relationships.

Medical debt negatively impacted respondents’ physical health and ability to take care of their health: As cited in the first brief, among respondents with current medical debt:

- 50% skipped seeing a doctor when I needed to.

- 45% skipped routine care such as check-ups, screenings and vaccines.

- 39% reported that medical debt negatively affected their ability to fight their illness.

- 25% skipped or reduced taking medications.

These avoidance behaviors (aka “deferred care”) increase the risk of devastating health outcomes and the cost of care, which is bad for workers, their employers, and the economy.

Recommendations for Employers

- Start by surveying your employees or conducting focus groups: Understand how/if medical debt is impacting their financial, mental or physical health, and ask them what would be most helpful to them.

“This exercise will not only display care for your employees, which alone is shown to increase loyalty, productivity, and engagement, but also surface opportunities to improve benefits.”

For example, PayPal found that by increasing employer-subsidy towards healthcare premiums, many employees were able to enroll in plans that better met their needs.

- Don’t limit HSA contributions to a match structure: Contribute to HSA or FSA accounts, regardless of whether employees are able to contribute themselves, and ensure employees are informed about how to use these accounts to their full potential.

- Ensure your healthcare benefits cover mental health care such as therapy: Incorporate dedicated mental health days into your personnel PTO policies. Alternatively, offer an EAP that provides affordable access to mental health care.

- Ensure your healthcare benefits include telehealth: Enable access to affordable preventative care and reduce dependence on costly emergency rooms as the only means of accessing treatment.

- Permit employees (particularly hourly workers) to attend doctor’s appointments during the workday: Doctor offices are often only open during typical business hours. Do not penalize employees for seeking care, either allow them to attend appointments during paid time or enable them to make up the hours.

- Provide info about free medical debt-specific resources: Organizations like Dollar For help individuals understand and negotiate their medical bills.

In the end, the “interrelated nature of medical debt with financial security means that employers have an opportunity to have an outsized impact on their employees’ well-being by investing further in their healthcare and complementary benefits,” per the brief.

Smart employers will seize it.

“The Negative Impact of Medical Debt on Overall Health” is informed by the experiences of TrustPlus clients and RIP Medical Debt beneficiaries. TrustPlus is a service of Neighborhood Trust.