Financial wellness benefits for employees, 2023 in review

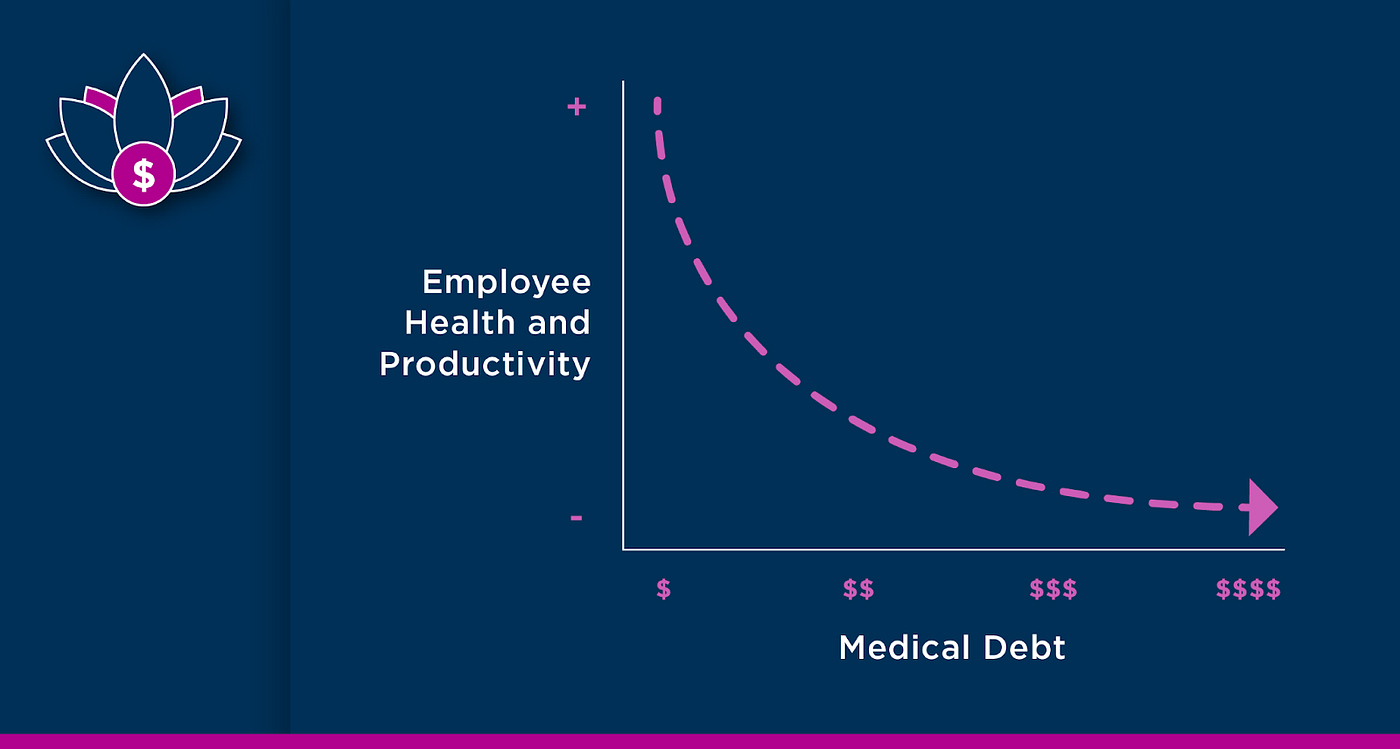

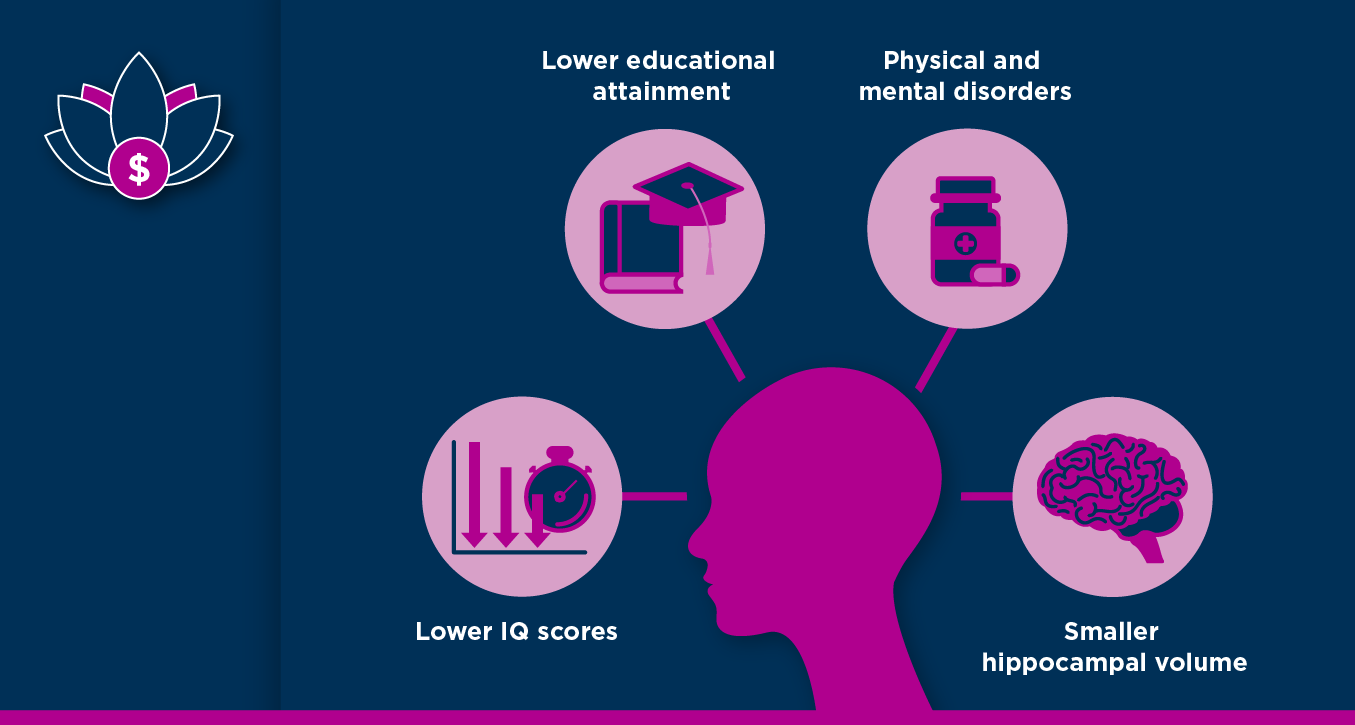

Employees’ top financial stressor went from saving for retirement to saving for emergencies and making it to the next paycheck, amidst rising credit card, auto, medical, and student loan [...]