70 percent of people in the U.S. are stressed about their finances and 58 percent are living paycheck to paycheck, finds CNBC’s Financial Confidence Survey conducted in partnership with Momentive.

No income bracket is immune including a majority of workers earning $100,000 or more.

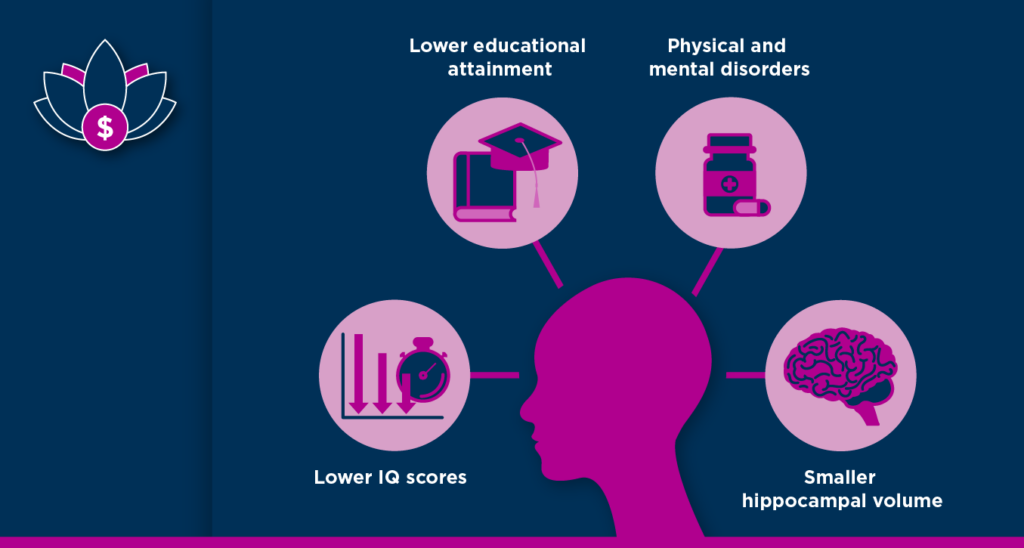

When your workers are stressed it’s bad for their health and for your business or organization.

A recent report out of the National Payroll Institute in Canada found that employee financial stress cost companies more than $40 billion in lost productivity in 2022, up from $26.9-billion lost in 2021. In the U.S. the number is closer to $40 quadrillion. OK, we exaggerate. But it’s a lot.

A confluence of unfortunate events is conspiring to keep the financial pressure on for U.S. workers: the rising cost of necessities like food, shelter, and utilities; a sense of uncertainty about our financial system in general from recent bank failures; and skyrocketing household debt which is up $38 billion from a year ago according to the U.S. Federal Reserve. Credit card balances and delinquency rates are also on the rise.

Employees want Personal Financial Coaching

The declining finances of the U.S. worker has led us to where we are now when the vast majority of employees, almost seven in ten, want financial wellness benefits like coaching that helps them manage and avoid debt.

While most employers offer some form of financial wellness benefit, Personal Financial Coaching remains a largely untapped resource for businesses and organizations nationwide.

Only one in four (24 percent) HR professionals say their employer offers Financial Coaching to all employees. Yet, most of the coaching that is offered is not personal to the employee. It is typically delivered via digital tools or generic group training sessions, which data show doesn’t work.

Millennials and Gen Z workers, especially, expect employers to offer benefits and financial wellness support that previous generations couldn’t even imagine because they face greater financial challenges than their parents’ and grandparents’ generations. In fact, Millennial workers, twenty- to forty-somethings, are worse off financially than their parents’ generation, for the first time in U.S history. Employers are paying attention. What you do about it will separate the winners from the losers in the coming decade.

TrustPlus blends human connection with digital tools

Our award-winning, proprietary, approach blends human connection with action-oriented tools and workplace products. TrustPlus Personal Finance Coaches work one-on-one with your employees on an ongoing basis to optimize debt, strengthen credit, and build savings. These ongoing relationships lead to reduced stress for employees and sustainable value for employers.

Whether you’re looking to enhance recruiting and retention, reduce employee stress and absenteeism, or improve mental health and the bottom line, TrustPlus wants to talk with you about cultivating and harnessing the benefits of a financially healthy workforce.