TrustPlus resources to support worker financial health

TrustPlus resources to support worker financial health

Employers should prepare for changes to Earned Wage Access now

“If you are an HR leader who offers Earned Wage Access (or is considering offering EWA) and you aren’t operating under the assumption that your employees will need a [...]

Is your 401(k) employer match suppressing savings, equity?

Your 401(k) employer match is exacerbating income inequality, suggests research from Vanguard and from economists at MIT, Harvard, Yale, and the Census Bureau. What’s a smart employer committed to [...]

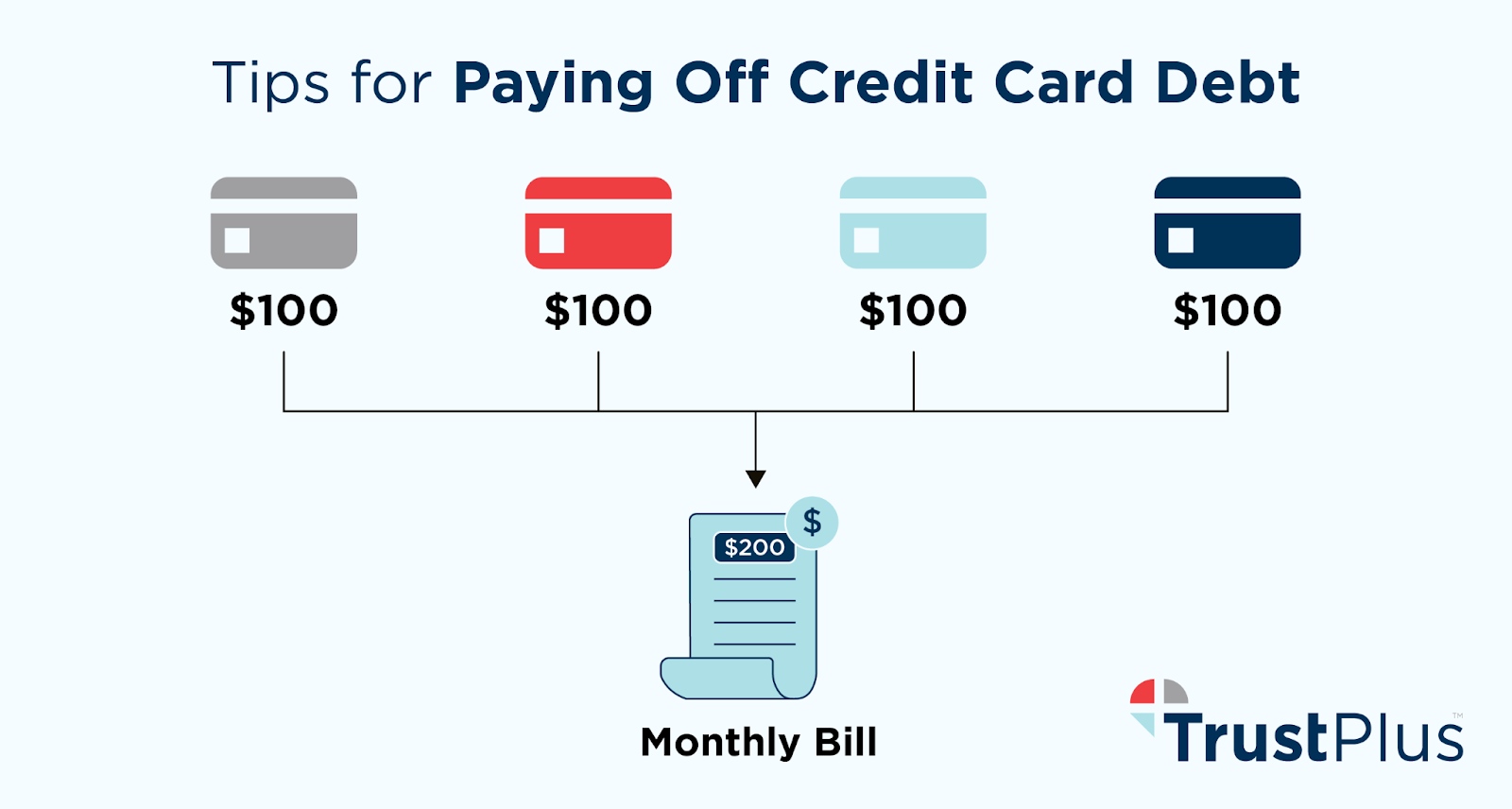

Is credit card debt among your workers hurting your organization?

Rising credit card debt, like rising usage of Earned Wage Access apps, is a symptom of a larger problem: worker cash-flow gaps in what the Aspen Institute calls the [...]

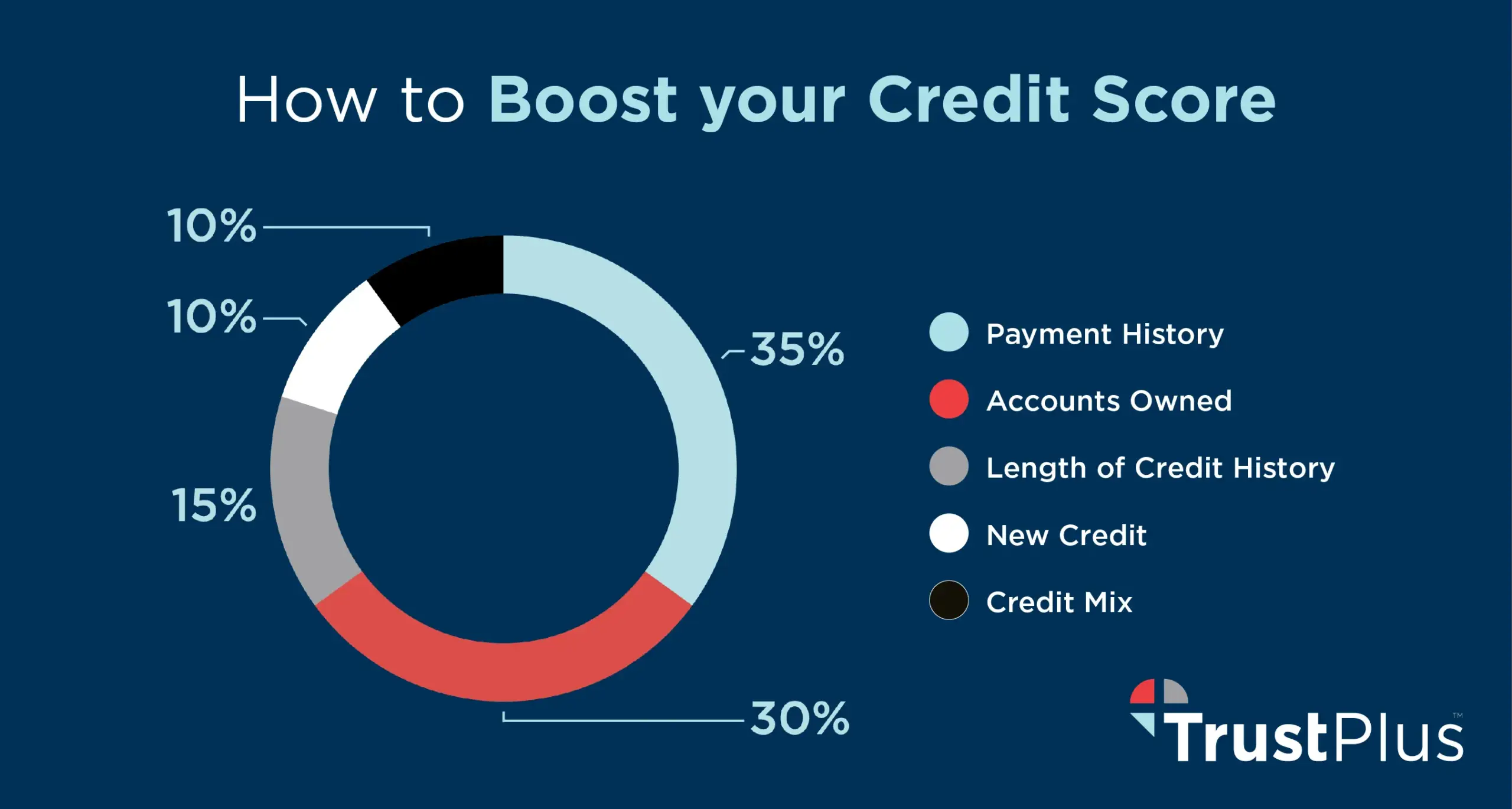

Smart financial wellness programs include credit improvement

Credit improvement is a key pillar of how smart employers think about financial health. Prime credit scores save workers money on interest payments and fees, enable them to qualify [...]

Financial wellness benefits should account for collections debt

Millions of workers have debt in collections, mostly from medical debt (still), which can drag on worker health, productivity, and credit, and your organization, for years. [...]

Is your financial wellness program climate resilient?

Effective financial wellness programs account for spiking energy costs and your workers’ diminishing ability to afford to stay cool this summer. It’s a matter of life and death for [...]

Reduce employee financial stress this summer

Savvy employers understand that millions of workers will turn to high-cost debt to fuel summer vacations, and that reducing employee financial stress is good for your employees, organizational impact, [...]

June 30 is deadline to apply to consolidate student loans

To be eligible for a one-time federal initiative that could wipe out their debt from student loans, 3.5 million workers with privately-held Federal Family Education Loans (FFEL), Perkins Loans, [...]

Employers, embrace home buying education

Employers benefit when workers understand the pros and cons of new products coming on the market in response to high home prices and borrowing costs, like the return of [...]

Can financial wellness benefits reduce rising debt among workers

The percentage of credit card balances in serious delinquency climbed to its highest level since 2012 according to the latest data from the Federal Reserve Bank of New York. [...]

How smart employers think about financial wellness benefits

You’re after financial capability and action born of knowledge, not knowledge alone. Smart employers understand that a do-it-yourself employee financial literacy program, alone, is a waste of scarce resources. [...]

How to reduce workers’ medical debt, boost financial health

New research from Neighborhood Trust informs five recommendations for employers to boost ROI on health benefits spending Employers are uniquely positioned to help reduce workers’ medical [...]

Ease employee financial stress this spring

Spring offers HR for small businesses low-cost opportunities to engage employees around financial health Ease employee financial stress and good things happen: a maxim worth [...]

Personal financial coaching for nurses is good for all

Hospitals and health systems can save money, strengthen recruiting and retention, and improve health outcomes by investing in the financial health of your workforces Personal [...]

Debt reduction strategies to close the gender gap in “burdensome debt”

More women report carrying unmanageable levels of debt than men. Women’s History Month is a great time to explore how employers can help, and why doing so is smart [...]

Understanding debt consolidation loans: A simple guide

Juggling multiple debts from different creditors can be overwhelming and hard to keep track of. If you find yourself in this situation, consider a debt consolidation loan. [...]

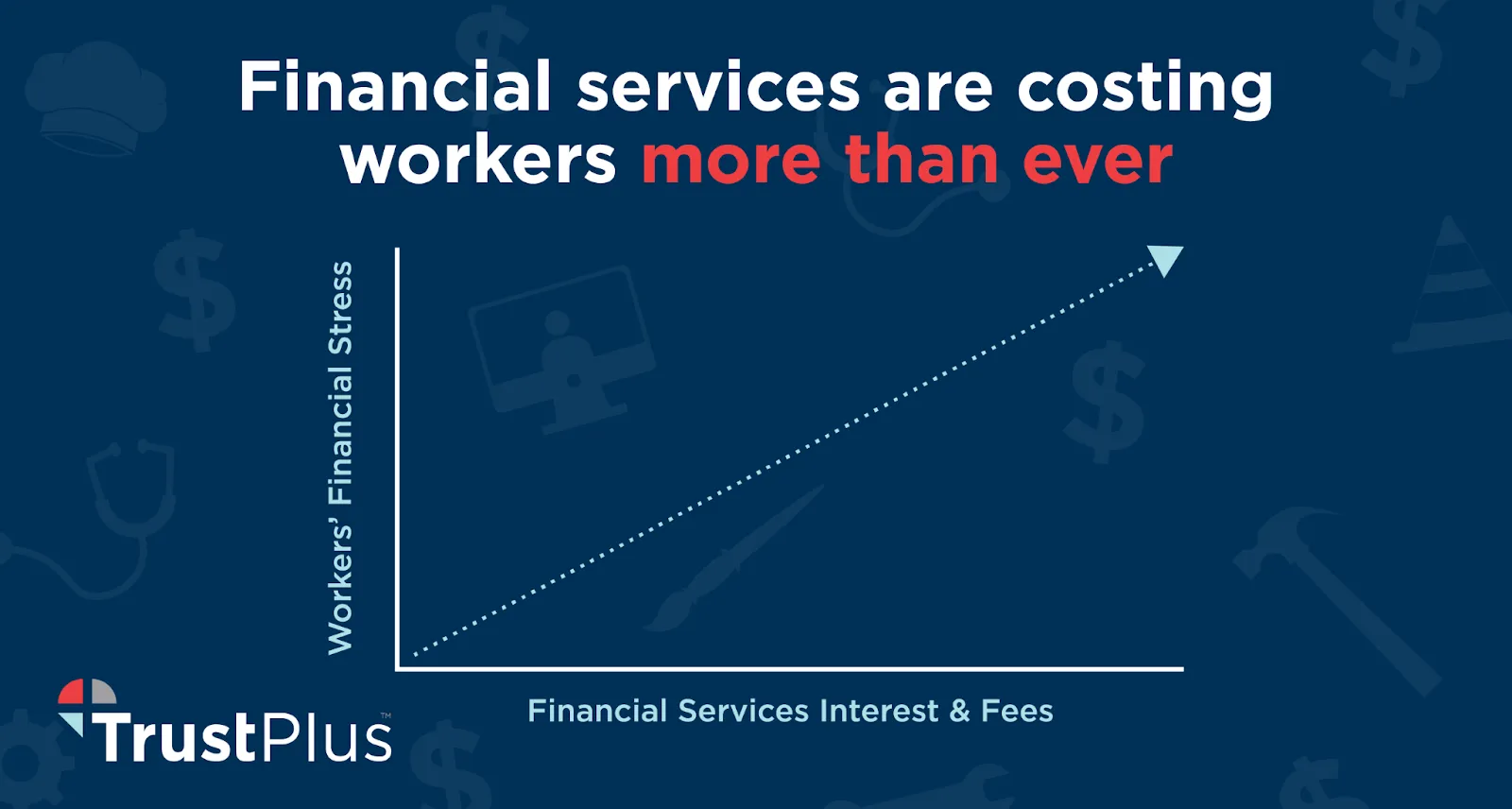

Boost benefits-spend ROI with personal financial coaching

HR leaders looking to boost benefits-spend ROI can solve for workers’ top stressor, personal finances, with a solution as flexible as financial challenges are diverse, amidst all-time high costs [...]

Reduce employee financial stress with TrustPlus

Employee financial stress spikes as debt rises. Credit card debt is at an all-time high according to the latest data from the Federal Reserve Bank of New York. TrustPlus [...]

Employers should prepare for changes to Earned Wage Access now

“If you are an HR leader who offers Earned Wage Access (or is considering offering EWA) and you aren’t operating under the assumption that your employees will need a [...]

Is your 401(k) employer match suppressing savings, equity?

Your 401(k) employer match is exacerbating income inequality, suggests research from Vanguard and from economists at MIT, Harvard, Yale, and the Census Bureau. What’s a smart employer committed to [...]

Is credit card debt among your workers hurting your organization?

Rising credit card debt, like rising usage of Earned Wage Access apps, is a symptom of a larger problem: worker cash-flow gaps in what the Aspen Institute calls the [...]

Smart financial wellness programs include credit improvement

Credit improvement is a key pillar of how smart employers think about financial health. Prime credit scores save workers money on interest payments and fees, enable them to qualify [...]

Financial wellness benefits should account for collections debt

Millions of workers have debt in collections, mostly from medical debt (still), which can drag on worker health, productivity, and credit, and your organization, for years. [...]

Is your financial wellness program climate resilient?

Effective financial wellness programs account for spiking energy costs and your workers’ diminishing ability to afford to stay cool this summer. It’s a matter of life and death for [...]

Reduce employee financial stress this summer

Savvy employers understand that millions of workers will turn to high-cost debt to fuel summer vacations, and that reducing employee financial stress is good for your employees, organizational impact, [...]

June 30 is deadline to apply to consolidate student loans

To be eligible for a one-time federal initiative that could wipe out their debt from student loans, 3.5 million workers with privately-held Federal Family Education Loans (FFEL), Perkins Loans, [...]

Employers, embrace home buying education

Employers benefit when workers understand the pros and cons of new products coming on the market in response to high home prices and borrowing costs, like the return of [...]