For many of our clients the holidays bring joy but also financial strain and mental health challenges. They are not alone. Stress and anxiety increase around the holidays nationwide, with gift giving gatherings with friends and family, travel and food, on the horizon, not to mention their associated price tags.

TrustPlus Personal Finance Coach Dametria Douglas

In our latest Personal Finance Coach, personal finance expert Dametria Douglas discusses strategies she shares in Personal Finance Coach sessions with employees at small and medium businesses from coast-to-coast, to boost mental and financial health, and productivity, around the holidays.

We offer it as a resource for employers who are eager to capture the productivity, recruiting, retention, and employee wellness benefits of a financially healthy workforce. ’Tis the season.

Start saving now.

Around this time of year, I suggest clients start saving for the spending that they’re going to do around the holidays to minimize how much they rely on credit. Think of it as a bucket of money to pull from that helps create boundaries around how much you want to spend. This is always easier said than done of course, because of, you know, reality.

Avoid holiday credit promotions.

Store credit cards tend to have higher interest rates than what we think of as regular credit cards. While that holiday promotion may sound amazing, free money forever with 110% off, at first, it usually is too good to be true. If there is one promotion that is very appealing, make sure you can pay the statement balance in full when the bill comes to avoid interest. In general, the answer to the question of opening store credit for a discount is “no”!

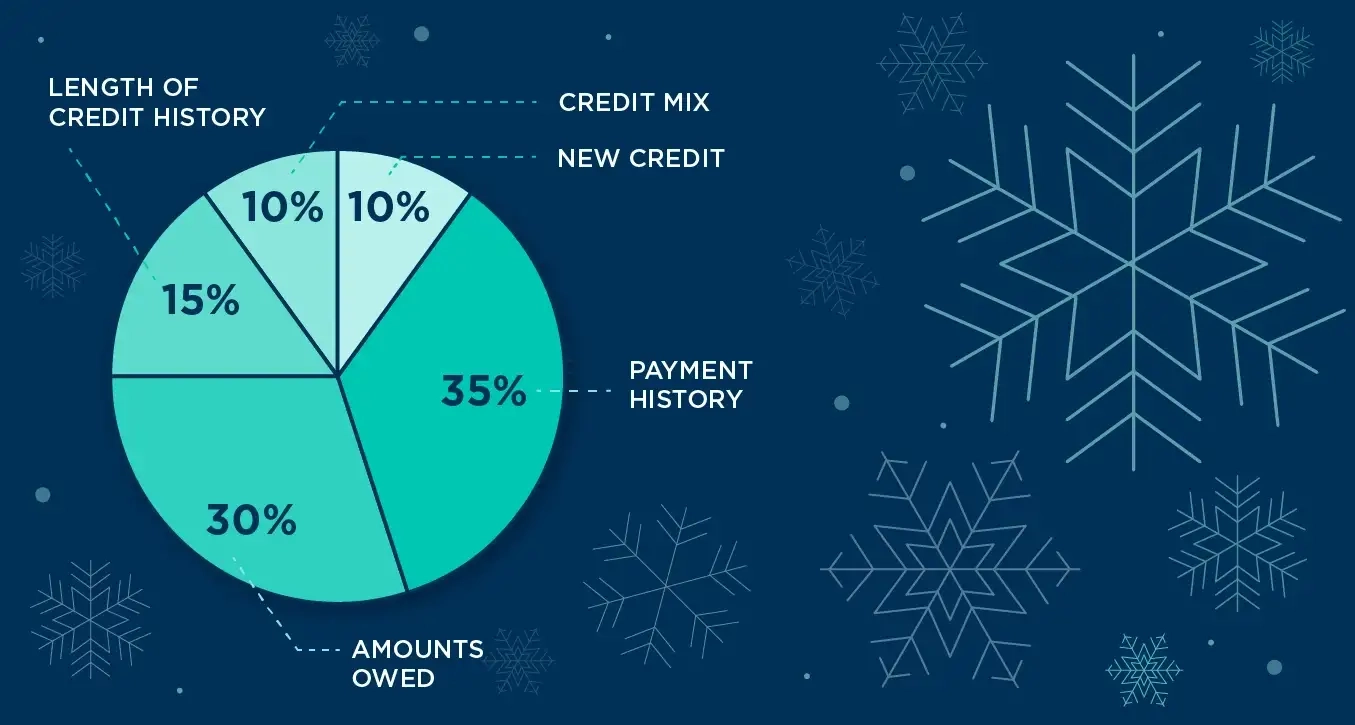

Another reason: Every time you apply for credit there is a “hard inquiry” on your credit report and your credit score takes a ding. Your credit score is made up of five different categories, and one of them is new credit roughly 10% of your credit score pie.

Make credit work for you.

30% of your credit score is based on the amount of debt you owe. If you stay between 10% and 30% of your credit limits then your score kind of stabilizes out. But if you keep your debt to below 10% of your limits, then your score tends to increase because you’re perceived by lenders as using your credit wisely.

Also, creditors will close accounts you don’t use, so if you have credit cards that you don’t use then you should use them periodically, keep any balance below 10% of your limit, and pay the statement balance in full. If you don’t then you’re at risk of shortening your credit history, which is 15% of what determines your credit score. So, aim to use your credit cards periodically. That history stays on your credit report and ensures credit is working for you. We’ll cover in an upcoming article how to make all of the pieces of the credit score pie work for you.

Make a plan, budget.

When clients first book sessions with me the priority goal is often to improve or build credit. To do that we first need to know what’s happening in the household, what’s the income coming in and what are all of the expenses that are going out. We walk through a very thorough process. One might not think to add haircuts into the budget. We’re going to do that because we want every dollar typically spent to be in the budget.

I always ask about gifts and celebrations. Do you have a wide social network? Does it seem like every month that it’s somebody’s birthday, anniversary, promotion, wedding? Are you constantly spending money on gifts and celebrations? Then I recommend that we put some money in a separate savings account for gifts, especially around the holidays. The important thing is to make a budget and to have a plan, not only about the holidays but about your overall financial health. Wherever you are financially, together we make a plan to build credit, save money, and manage debt, throughout the holidays and beyond.