New research from the Financial Health Network and SSRS, supported by Principal Financial Group’s Principal Foundation offers “policy- and employer-level solutions that could make a meaningful difference in leveling the playing field for women.”

Is the gender financial health gap costing your business money? Chances are, yes, and a recent report from the Financial Health Network (FHN) and SSRS, supported by Principal Financial Group’s Principal Foundation, offers details on “policy- and employer-level solutions that could make a meaningful difference in leveling the playing field for women,” and, thus, in your bottom line.

Today, we explore the gender financial health gap, how it hurts your business, and what you as a business owner or leader can do about it.

The gender* financial health gap.

According to FHN, financial health is “a composite framework that considers the totality of people’s financial lives: whether they are spending, saving, borrowing, and planning in ways that will enable them to be resilient and pursue opportunities.”

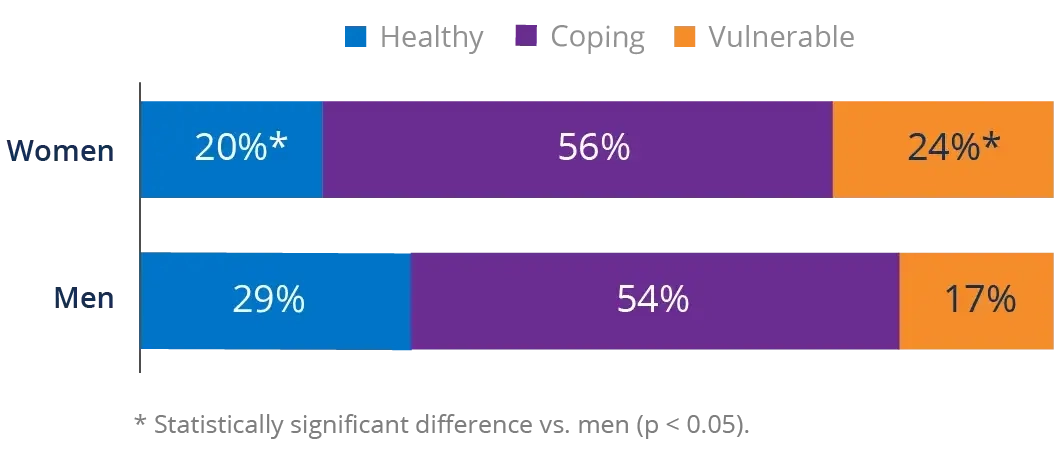

Their recent report, “The Gender Gap in Financial Health Identifying Barriers and Opportunities for Improving Women’s Financial Health,” finds that men are roughly 1.5 times more likely to be Financially Healthy than women; only one in five women (20%) are Financially Healthy versus 29% of men; and, disparities among women by race and ethnicity are vast with 25% of White women being Financially Healthy, compared with just 11% of Black women, and 7% of Latina women.

We see these gaps and their impacts on workers’ lives and productivity everyday: 70% of TrustPlus clients in 2021 identified as women and they cumulatively reduced their debt by $11,849,517 last year.

How does the gender financial health gap hurt your business?

Writing for the Society for Human Resource Management (SHRM), Joanne Sammer, in “How Improving Financial Health Boosts Productivity,” offers a useful overview that boils down to employees are spending time at work on personal finance issues and costs accrue to businesses in the form of lost productivity and absenteeism.

In one survey PricewaterhouseCoopers found that nearly half of employees who are worried about their financial health miss work and are less productive, spending at least three hours of work time on personal financial issues, costing $3.3 million in lost productivity per year, plus $166,000 per year due to financial-related absenteeism.

Helping to close the gender financial health gap among your workers is one tangible way to reduce absenteeism, increase productivity, and enhance loyalty, motivation, and retention, not to mention to improve mental health.

How to close the gender financial health gap among your employees?

Here are recommendations for employers adapted from FHN’s “The Gender Gap in Financial Health Identifying Barriers and Opportunities for Improving Women’s Financial Health:”

Create supportive workplaces through flexible work schedules, salary transparency, and restrictions on requesting salary histories. Check out TIME’S UP’s and ideas42’s guide to using behavioral practices to promote pay equity and FHN’s Employer FinHealth Toolkit which is a great resource for HR professionals looking to capture the value created by supporting employee financial health more broadly.

Expand benefits to part-time workers to “close the gap in individual retirement plan ownership for women, while expansion of affordable health care options could help women avoid medical debt.” FHN put together a helpful resource about actions that employers can take to help employees avoid medical debt.

Support financially struggling employees with financial coaching (ahem) or debt management services, programs like emergency savings or emergency grants, or contributions toward student loan repayments.

*Note on terms: We use the gender terms as listed in the report in this post.