What You Need to Know about the CARES Act

Brief Overview

The CARES Act is a $2 trillion emergency package signed into law on March 27, 2020 with the intention of mitigating the economic impact of the coronavirus pandemic.(1) Click here to view Spanish version.

It includes:

- One time direct payments to citizens who filed income tax returns in 2018 or 2019, who could not be claimed as a dependent of another taxpayer, and with adjusted gross income under certain limits(1)

- One time direct payments to non-citizens living and working in the US with a valid Social Security Number who filed income tax returns in 2018 or 2019, who could not be claimed as a dependent of another taxpayer, and with adjusted gross income under certain limits(1)

- One time direct payment to non-filers who are citizens or non-citizens with a valid Social Security Number that meet the substantial presence test. Non-filers include those who in 2018 and 2019 had gross income that did not exceed $12,200 ($24,200 for married couples). It also includes those who aren’t typically required to file taxes (such as Social Security beneficiaries, survivor beneficiaries, Railroad retirees, SSI, SSDI)

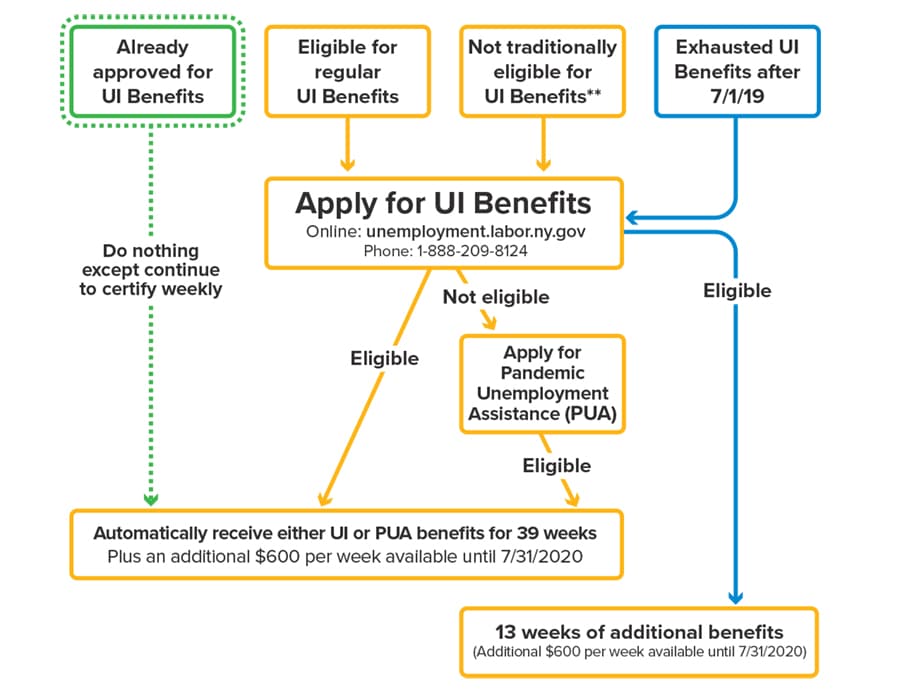

- An increase in the amount and an expansion of the eligibility of unemployment benefits(2)

- Loans (which can be partially or entirely forgiven depending on eligibility) for small businesses and non-profits(3)

- Free counseling and low-cost training for small businesses(3)

- Temporary pause on student loan payments and interest

06/19/20

Common Questions

One Time Direct Payments

Student Loans

Unemployment

Self-Employed/Small Business

Retirement Accounts

- https://www.nbcnews.com/politics/congress/coronavirus-checks-direct-deposits-are-coming-here-s-everything-you-n1168936

- https://www.nbcnews.com/politics/congress/coronavirus-unemployment-benefits-here-s-who-qualifies-how-much-they-n1169846

- https://www.sbc.senate.gov/public/_cache/files/2/9/29fc1ae7-879a-4de0-97d5-ab0a0cb558c8/1BC9E5AB74965E686FC6EBC019EC358F.the-small-business-owner-s-guide-to-the-cares-act-final-.pdf

- https://www.irs.gov/newsroom/economic-impact-payments-what-you-need-to-know

- https://www.nbcnews.com/politics/congress/coronavirus-checks-direct-deposits-are-coming-here-s-everything-you-n1168936

- https://www.syracuse.com/coronavirus/2020/03/coronavirus-stimulus-how-to-get-unemployment-aid-for-freelancer-contractor-part-time-workers-typically-left-out.html

- https://labor.ny.gov/ui/cares-act.shtm

- Dan LaRosa, Ritholtz Wealth Management

- https://studentaid.gov/announcements-events/coronavirus#zero-interest-questions>

- https://www.wilx.com/content/news/Some-mixed-status-families-wont-receive-stimulus-check–569798941.html