Tis the season for strengthening the financial health of your employees in 2023 to drive productivity and wellness, recruiting and retention.

TrustPlus Personal Finance Coach Dametria Douglas

Tis the season for gathering with family and friends…and for strengthening the financial health of your employees in 2023 to drive productivity and wellness, recruiting and retention.

Good credit can save your employees hundreds of thousands of dollars on everything from mortgages, credit cards, insurance, mobile phones, and more. Help make credit work for them and it will set them and your business up for success.

Personal Finance Coach Dametria Douglas encourages clients to regularly monitor their credit reports, especially if they’re trying to improve their credit score, and says that early January is a good time to think about financial goals for the New Year.

We spoke with Dametria about what goes into a credit score, why it’s important, and how she helps clients establish, strengthen, and improve credit.

What’s a credit report and why does it matter?

When I first meet with a new client I look at their credit report to see what their debt looks like, their utilization on credit cards, late payments, etc. Your credit report lists out the different types of credit you have, like a credit card, a car loan or personal loan, mortgage, what you owe on them and what your payment history looks like.

We start with the credit report because it paints a picture of how you utilize credit and influences a lender’s willingness to lend you money, and how much they’re going to charge you to lend you the money.

The flip side of bad credit is no credit. If you don’t have a credit history, you have the same liability as someone with negative things on their report because a lender doesn’t know anything about your money habits.

So, even if you don’t like using credit, you should still establish credit. You’ll be giving yourself more and better financing options down the line for major purchases like a house or a car.

What goes into a credit report?

TrustPlus Personal Finance Coach Dametria Douglas discusses what goes into calculating a credit score and why payment history is the most important factor.

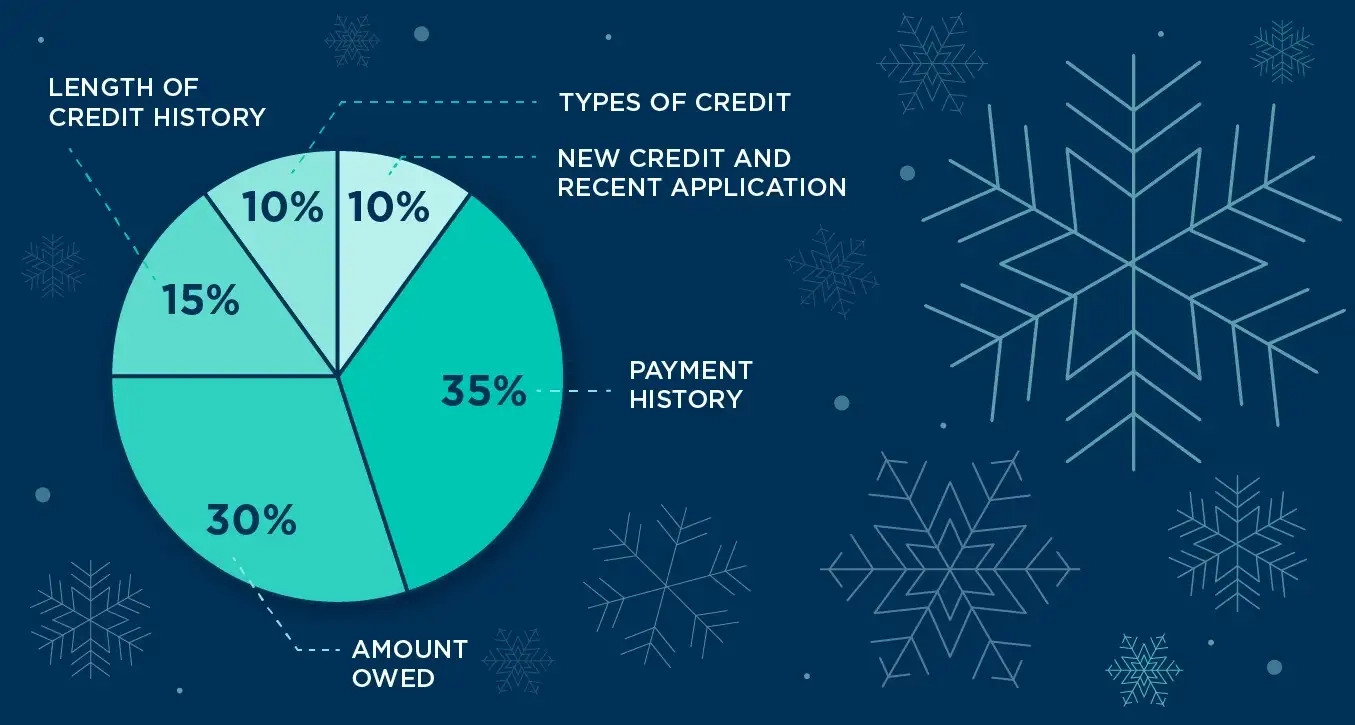

Think about your credit score as a pie and the credit score pie is made up of five different categories. The categories that lenders are reporting include looking at your payment history of paying bills on time, or not, which is 35 percent of that pie, the biggest chunk.

So when you don’t pay bills on time, when you miss payments, it has a greater effect on your score than anything else.

How often do you tell clients to check their credit report?

Check it at least once a year for sure. The beginning of the year is a great time to do that.

AnnualCreditReport.com now enables people to pull their credit for free from each major credit bureau once per week; it used to be once per year pre-COVID.

If you are in the process of improving and repairing some things on your credit report, then you want to look at it more often, every 60 to 90 days.

Credit Karma can come in handy here because they work with Equifax and TransUnion, two of the three major credit bureaus, to give members access to their scores and reports on demand. It helps my clients to make sure that the things they’re paying off are properly getting reported. Typically it takes 30 to 60 days to see changes.

If you’re in a space where you know you’re managing your credit well, you haven’t really made a lot of changes as far as opening new credit or paying things off then once or twice a year is probably sufficient. I probably look at my credit twice a year, every six months.

What’s the most important thing you tell clients about credit?

There’s always hope. Never get too discouraged if you don’t have the score that you want or you have a lot of things negatively reported on your credit report. All of it can be addressed in time. Things change in time. Things have less of an effect on your credit as time passes than when they first happen.

Even those late payments, when they stay on your credit report for seven years, they’re not having the same effect in year five as they had in year one. So, there’s always things that you can do to make a difference and start moving in the right direction. If you feel like there’s no hope: there’s always hope!

What’s your favorite part of working with clients to improve their credit scores?

TrustPlus Personal Finance Coach Dametria Douglas discusses how she loves working with clients to pay down debt and improve credit.

I love watching clients pay down debt and getting that credit card debt below 30 percent of its limit, eventually getting paid off, watching their credit score increase.

Helping clients get things removed from their credit report that isn’t theirs or has been addressed, and then watching the credit score go up, that’s always fun, to just kind of be a part of that journey with clients.

Schedule a time to speak with financial health and productivity expert Milly DuBouchet about how TrustPlus can help your business or organization capture the benefits of a financially healthy workforce.