Employers are in a unique position to help workers reduce stress during tax time which can boost productivity, mental health, and wellness. The deadline to file this year is April 18.

Many people feel overwhelmed when faced with filing taxes, which can lead to anxiety, guilt, and shame,” Joyce Marter, LCPC, writes in a recent article for Psychology Today on tips to manage stress during tax time.

If you’re an employer whose employees make $60,000 or less annually then this blog is for you, or rather for your employees who will benefit from not having to stress about filing taxes.

Below, TrustPlus Personal Financial Coach Ashley Denae Hannah walks through how to find free tax assistance from the IRS’s Volunteer Income Tax Assistance (VITA) program.

VITA sites offer free tax help to people who need assistance in preparing their own tax returns, including:

- People who generally make $60,000 or less;

- Persons with disabilities;

- Limited English-speaking taxpayers.

How to Find a VITA Site

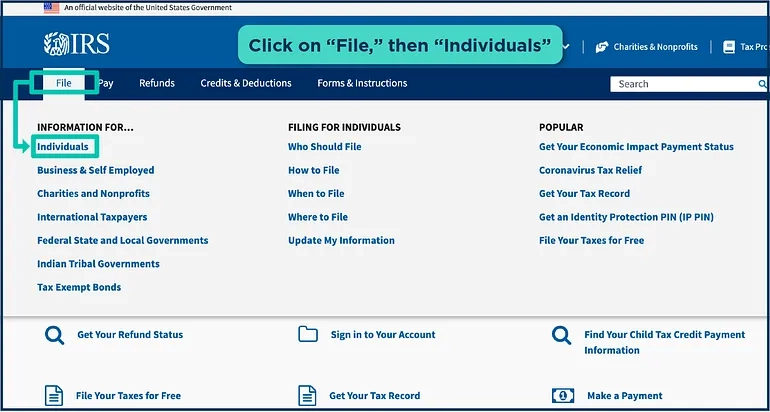

First, go to IRS.gov.

Click on “File.” It’s the first option on the navigation menu across the top of the page.

Then click “individuals.” It’s the first option listed on the left side.

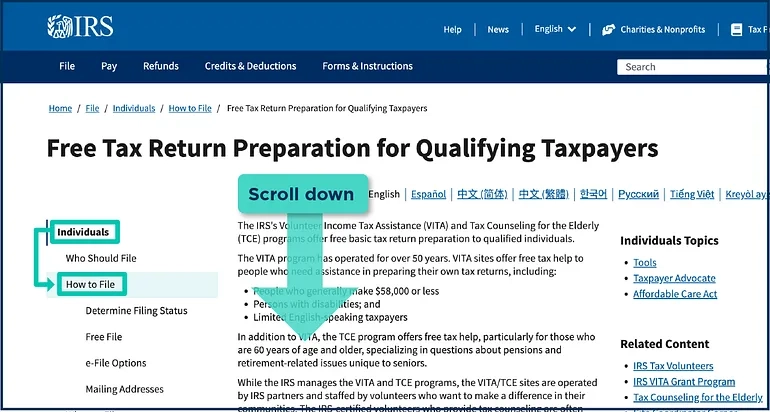

Next, scroll down to the box titled “File your taxes” in the middle of the page, to the left of the other box in the middle of the page titled “After you file your taxes,” and click on “Get free tax help from volunteers.” It’s the third bullet down.

You should now be on the “Free Tax Preparation for Qualifying Tax Payers” page.

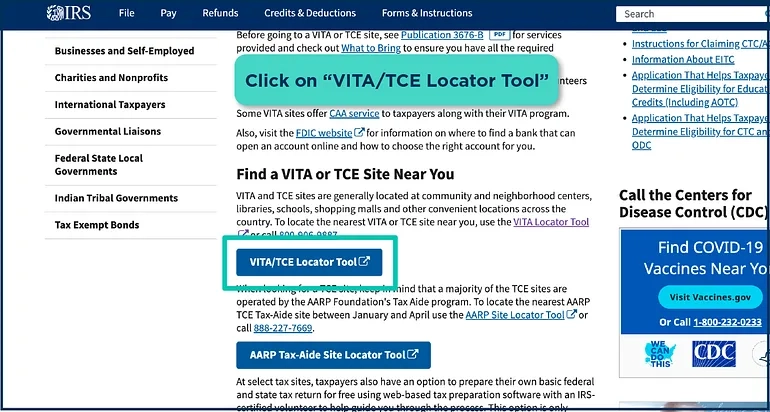

Scroll down and click “VITA/TCE Locator Tool.”

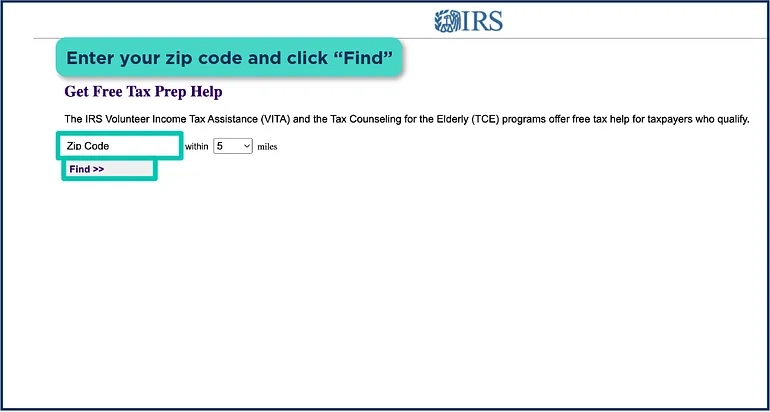

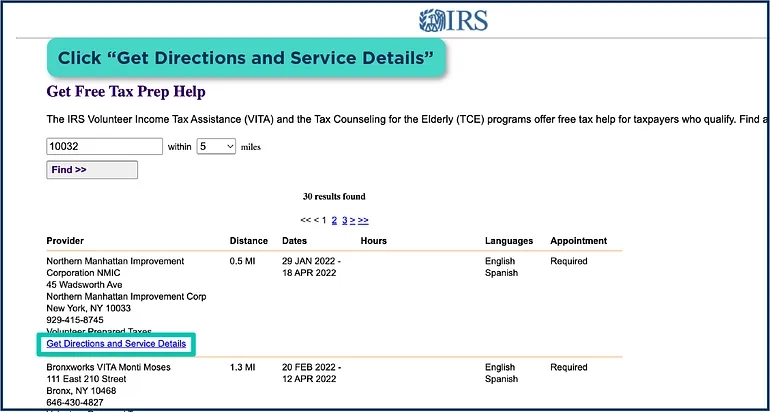

Enter your zip code and select within how many miles you’d like to search, then click “Find.”

Once you click “Find” you’ll see a list of sites with the distance from the zip code you entered and the dates that the sites are open including any specific hours.

They also list the languages they speak at each site and whether or not they require an appointment. As you will see, most sites require an appointment, although some do not, which means you can walk in.

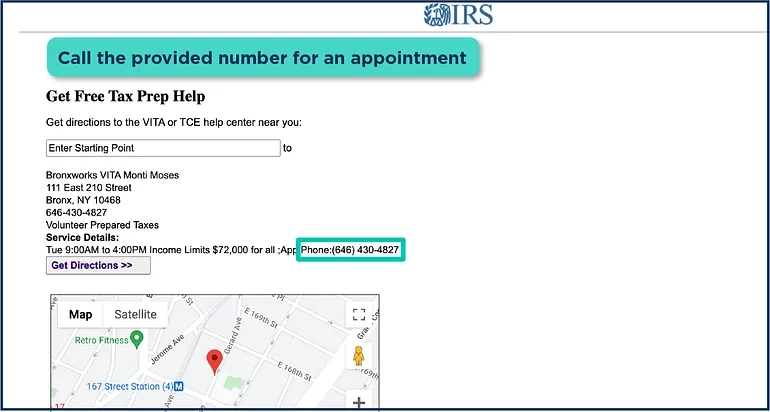

Once you find a site that you like, click the “Get Directions and Service Details” button and call the listed appointment number.

It’s very important to call as soon as you can. Often sites get booked quite quickly.

Once you have your appointment scheduled, you can go back to the IRS website and click “What to Bring,” which includes the following:

- Proof of identification (photo ID);

- Social Security cards for you, your spouse and dependents;

- An Individual Taxpayer Identification Number (ITIN) assignment letter may be substituted for you, your spouse and your dependents if you do not have a Social Security number;

- Proof of foreign status, if applying for an ITIN;

- Birth dates for you, your spouse and dependents on the tax return;

- Wage and earning statements (Form W-2, W-2G, 1099-R,1099-Misc) from all employers;

- Interest and dividend statements from banks (Forms 1099);

- Health Insurance Exemption Certificate, if received;

- A copy of last year’s federal and state returns, if available;

- Proof of bank account routing and account numbers for direct deposit such as a blank check;

- To file taxes electronically on a married-filing-joint tax return, both spouses must be present to sign the required forms;

- Total paid for daycare provider and the daycare provider’s tax identifying number such as their Social Security number or business Employer Identification Number;

- Forms 1095-A, B and C, Health Coverage Statements;

- Copies of income transcripts from IRS and state, if applicable.

This post updates TrustPlus Personal Financial Coach, Accredited Financial Counselor® & Financial Literacy Educator Ashley Denae Hannah’s post from last tax season. Schedule a time to speak with a TrustPlus financial health and productivity expert about how TrustPlus can help your business or organization capture the benefits of a financially healthy workforce.

This post updates TrustPlus Personal Financial Coach, Accredited Financial Counselor® & Financial Literacy Educator Ashley Denae Hannah’s post from last tax season. Schedule a time to speak with a TrustPlus financial health and productivity expert about how TrustPlus can help your business or organization capture the benefits of a financially healthy workforce.