27 Feb Close the racial retirement savings gap to boost savings overall

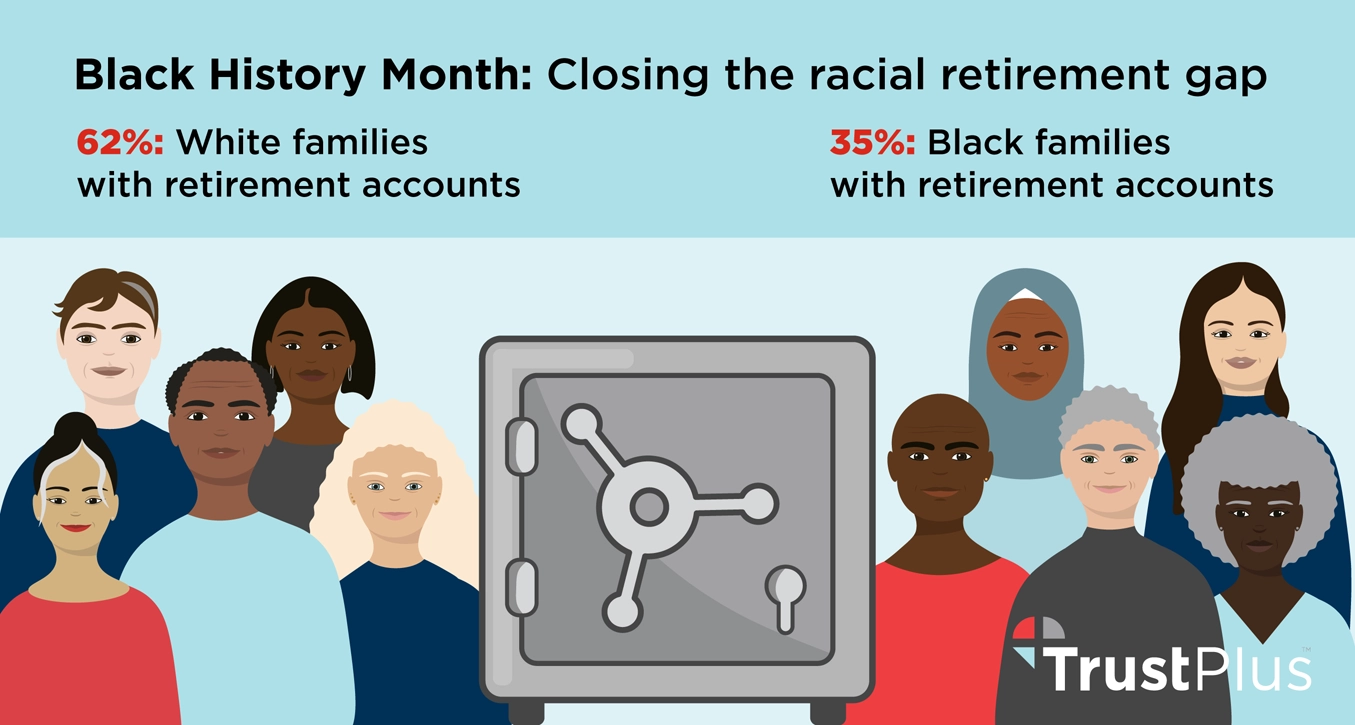

The racial retirement savings gap is shocking: 35% of Black families had retirement accounts in 2022 compared to 62% of white families according to the Federal Reserve. Research suggests employers who take steps to close the racial retirement savings gap boost savings overall. And that’s good for workers, profits, and impact. Close the racial retirement savings gap. It’s a noble goal, worthy of reflection always, and especially during Black History Month: 35% of Black families had retirement accounts in 2022 including 401(k) and individual retirement accounts compared to 62% of white families. This mammoth disparity is bad for business and for Black workers who...