A new brief from the Financial Health Network suggests that “financial coaching is unique in offering personalized and objective guidance” and that “there is demonstrable evidence that financial coaching improves financial well-being and changes financial behaviors.”

A new resource is available for all businesses and organizations who are interested in harnessing the retention, recruiting, productivity, and wellness benefits of a financially healthy workforce in 2023: Workplace Financial Health Innovation: Exploring the Spectrum of Financial Guidance Solutions for Your Employees.

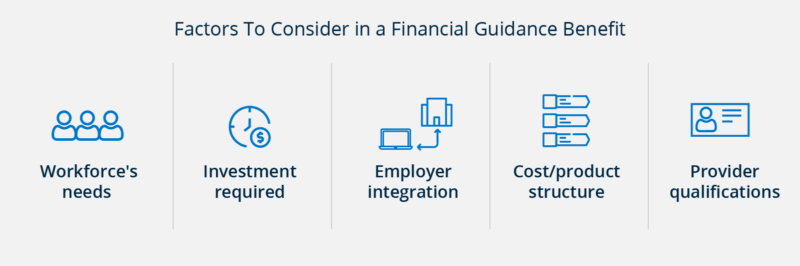

The latest brief from the Financial Health Network covers the many factors that employers should consider when exploring financial wellness benefits. It suggests that employers “will be wise to offer financial guidance solutions that meet their workforce’s specific needs.”

Financial Health Network

Among the various types of financial wellness benefits that exist, financial guidance is an increasingly common form of this support. Across the spectrum of solutions, financial coaching is unique in offering personalized and objective guidance across a range of topics to help employees make timely progress toward goals.

As for financial health benefits among employers and employees continues to grow, smart businesses and organizations are increasingly turning to financial coaching that offers personal guidance.

“Unlike financial education solutions, financial coaching presents actionable and personalized solutions, such as creating budgets and monitoring progress. There is demonstrable evidence that financial coaching improves financial well-being and changes financial behaviors.

Schedule a time to speak with financial health and productivity expert Milly DuBouchet about how TrustPlus can help your business or organization capture the benefits of a financially healthy workforce.